From early product to global architecture

Role

Product Designer

Company

InDebted

Type

Research, UX, UI, Product management, Design system, Rebranding

Impact

83% conversion improvements

InDebted is a fast-growing start-up focused on expanding into new markets and increasing revenue. To achieve the founder’s vision of becoming the world’s most trusted collections agency, the business needed to find new ways to improve product performance

Some of our clients

Challenge

With $117M locked in active plans but just 9% completed, the challenge was to turn payment plans from a leaky funnel into a growth engine.

My role

Hybrid Product Designer / Acting PM, bridging compliance, engineering, and stakeholders.

I led:

Discovery, scoping, and feature design

15 customer interviews (AU + US)

Problem framing with Head of Product

Translating insights into product direction

Research method and finidings

Explore and understand how we can improve payment plan experience.

👉

User selection criteria and Askable recruitment

Moderated interviews (8 AU, 7 US)

45 minutes session

Balance between $50 to $250

30 to 90 days aged accounts

Afterpay and Klarna customers (BNPL)

Customers currently on payment plans

🧠 Key insights

Budget-first

Customers set plans around living expenses, not duration.

Cognitive overload

Too many steps and unclear info → backtracking.

Trust and control

Customers wanted clear obligations and self-service flexibility.

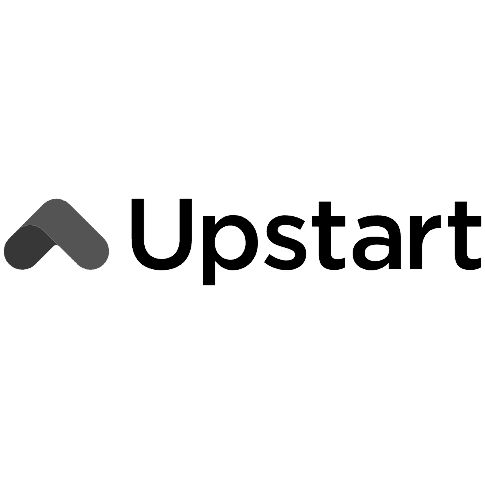

Where the current flow falls short

By analysing customer behaviour and UI patterns, we identified key opportunities to improve the plan setup flow:

Guardrails: Some customers created plans lasting over 19 years, highlighting the need for clearer limits.

Flow complexity: Amplitude showed drop-off was driven by too many steps in the journey.

Backtracking: Customers frequently clicked back and forth, trying different amounts and frequencies a sign the UI wasn’t guiding them effectively.

Learning from MVP

The first release had to cut critical elements like toggles, sliders, and upfront summaries. While it simplified delivery, these tradeoffs limited the impact and the metrics didn’t shift as expected. This highlighted the importance of balancing feasibility with user needs even small compromises in control and clarity can blunt adoption.

~ +0.9% uplift in conversion only. 👎

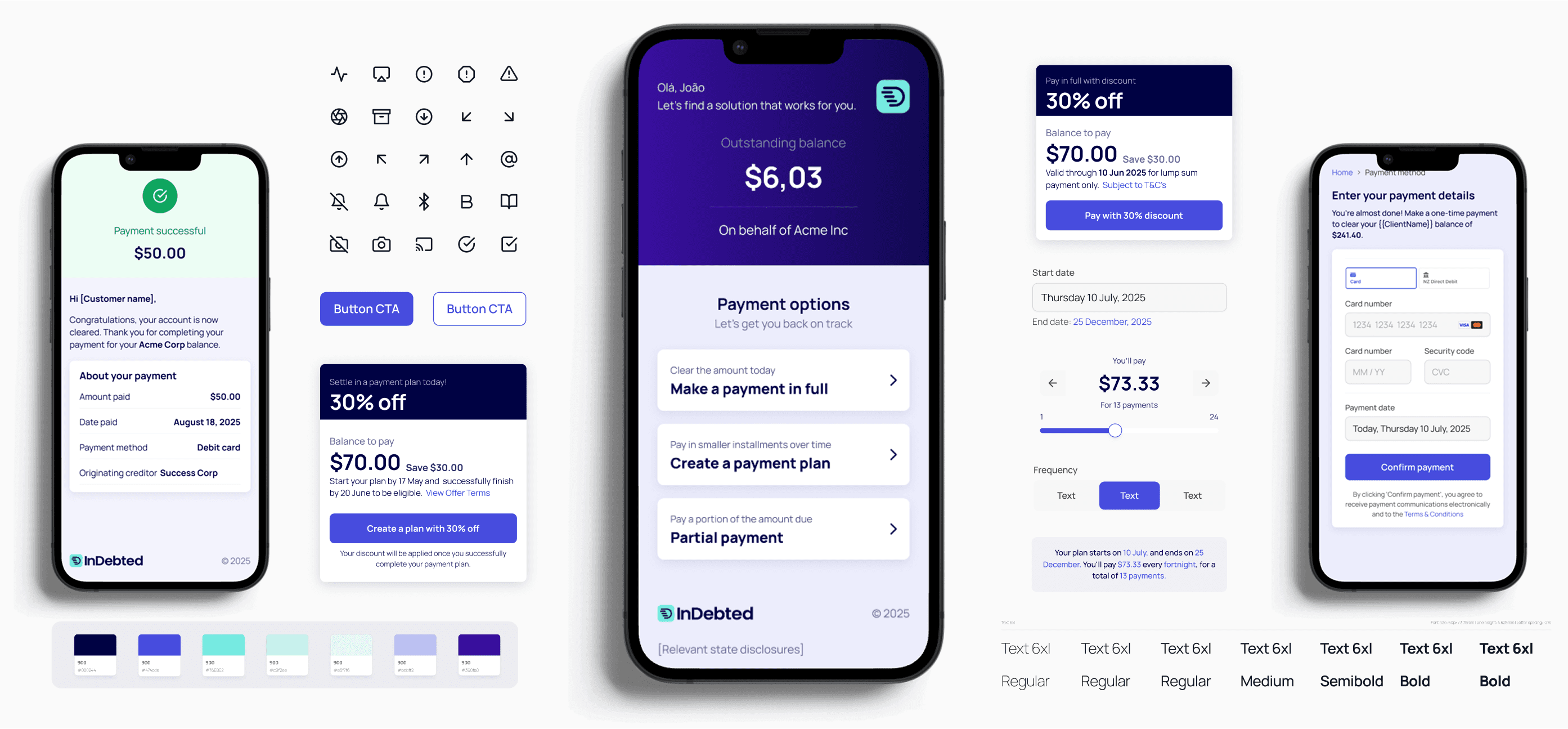

Unlocking New Capabilities

Once the new architecture was in place, we could finally build features the old system could never support. This wasn’t just a UX update it was a future-proof foundation that unlocked entirely new ways for customers to manage payments and for clients to recover faster.

New capabilities included:

Tiered settlements – breaking down large balances into structured tiers

“Promise to pay” arrangements – scheduling one-off commitments without a full plan

Abandoned cart recovery – re-engaging customers who didn’t finish setup

Discounts & flash sales – offering time-bound incentives safely

Flexible self-service plan management – empowering customers to adjust plans within guardrails

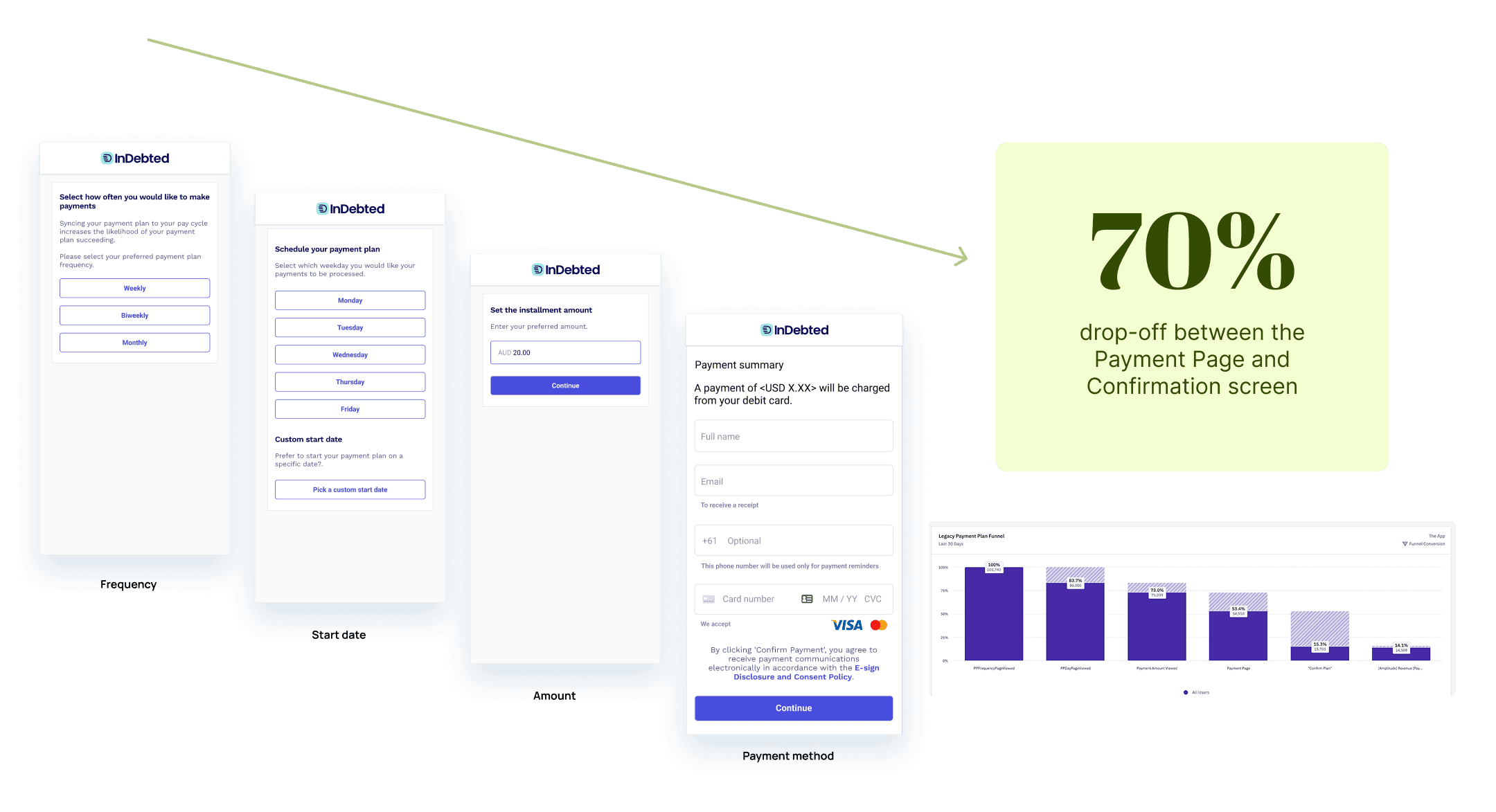

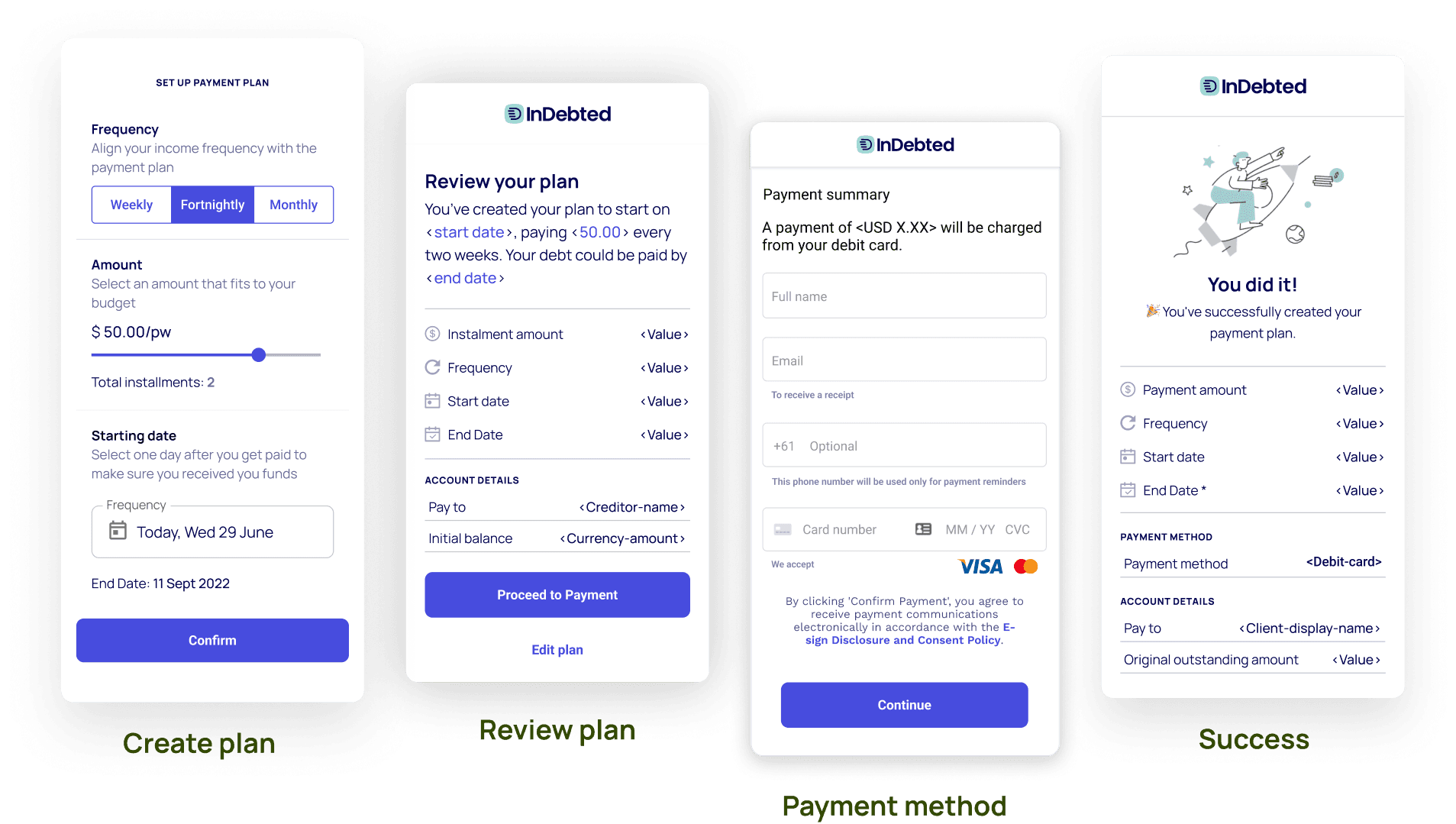

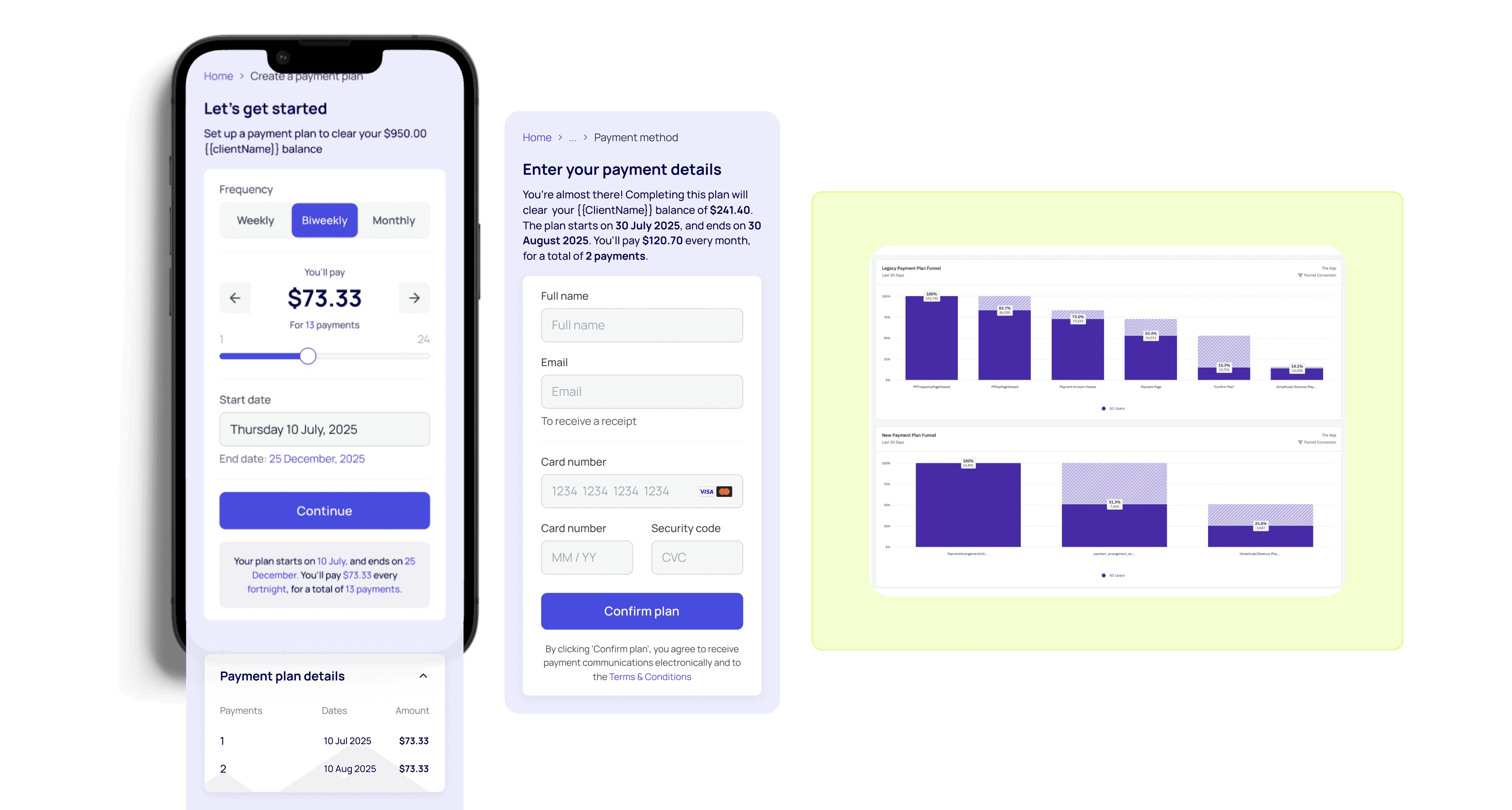

New Payment Plan & Rebrand

Once the new architecture was live and the front end modernised, we enhanced the payment plan experience itself.

We redesigned the flow into a single-screen experience where customers could select and confirm their plan in one place plus updating inDebted brand uplift.

This simplified the journey and reduced friction.

For first-time users, it could feel overwhelming, but we tracked success and key metrics to balance simplicity with usability.

New payment plan results

uplift in overall conversion

Screen payment plan set up

A/B test

Markets that we first shipped

🇳🇿 🇨🇦 🇲🇽 🇦🇪

Conversion

Old: 14.1% conversion (14,508 of 102,740)

New: 25.8% conversion (3,847 of 14,891)

Average Recovery time

Old: 175 days

New: 58 days

Max Recovery time

Old: 7063 days (19+ years)

New: 487 days

Average instalment

Old: $66.35

New: $72.40

Wrapping up

This project started as a UX improvement but evolved into a full platform rebuild.

From MVP: a modest uplift (+0.9%).

Through alignment workshops: a shift to architectural reset.

To launch: a scalable, rebranded system that boosted conversion, reduced recovery time, and gave customers more control.

Key learnings

Lean design delivers real impact: Each MVP was scoped for fast learning, not just polish

Self-service is scalable UX: These tools didn’t just reduce support but strengthen the brand

Compliance can drive clarity: Constraints helped us design cleaner, user-initiated flows

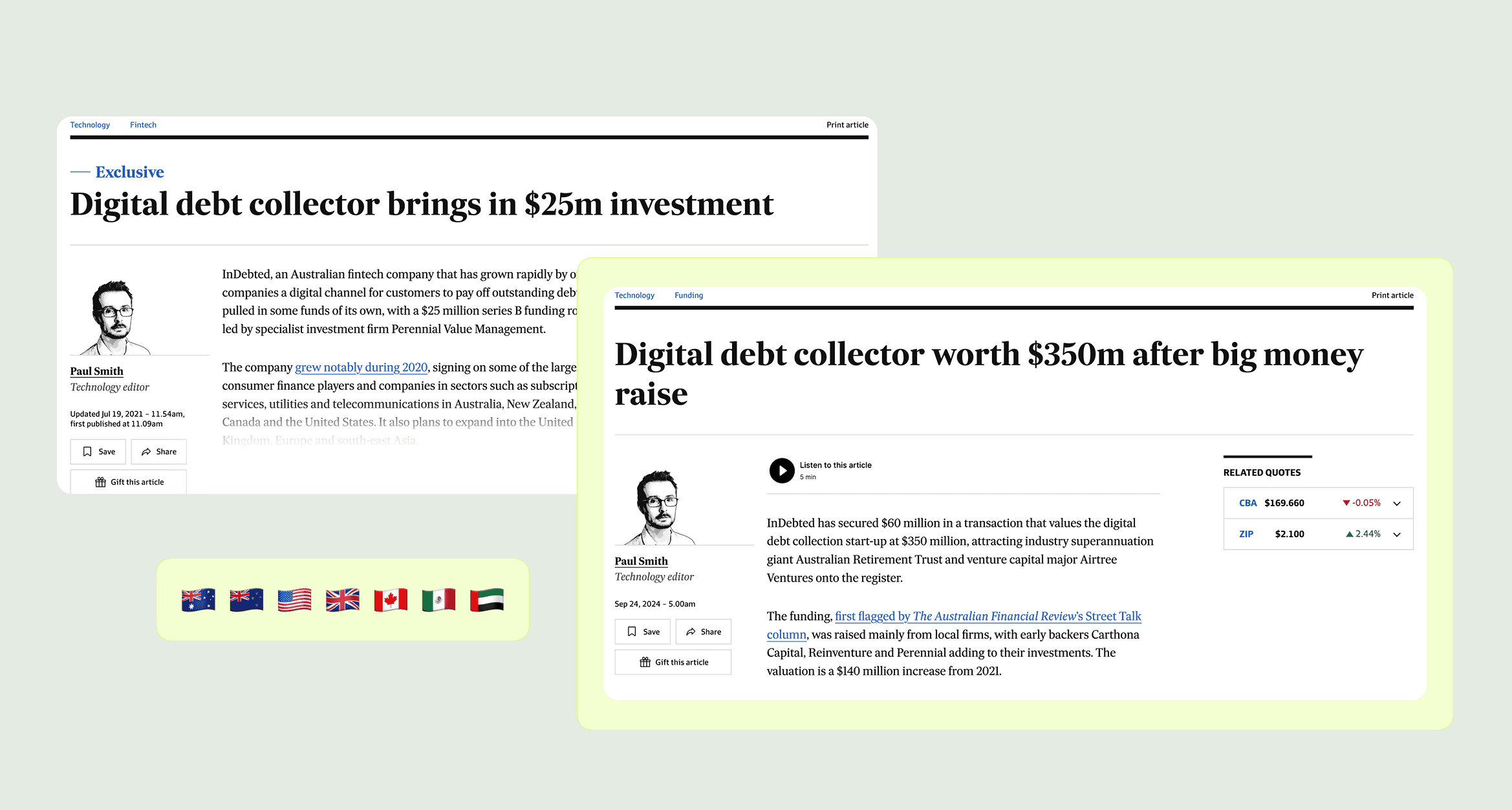

This project was one of several key initiatives that helped the business secure multiple successful funding rounds, driving its valuation from $140M to $350M.