People’s Choice Credit Union — UX Design, Research & Testing

Role

UX Designer

Company

People's Choice

Type

Research, UX, UI, Product management,

Impact

Led a payments experience that boosted revenue by up to 30%

When I joined the project, People’s Choice was in the middle of a big digital transformation. Their back-office were moving to Salesforce, rebranding, and trying to modernise every part of their experience. The public website was still sitting on a ten-year-old system and didn’t reflect where the organisation was heading.

Challenge

The old site was cluttered, full of jargon, and hard to use on mobile. Teams had added things over time, so it felt disjointed. Our goal was simple: make it easy for people to find what they need quickly while supporting the new brand, accessibility, and content system.

My role

I joined as the UX designer working with the Member Experience team and collaborating heavily with marketing. I led the user research, information architecture, prototyping, and usability testing. My focus was to make the experience simple, clear, and built around what members actually needed, not what the organisation wanted to promote.

✔️ Research (Qual) | ✔️ User Interface | ✔️ Prototyping | ✔️ Product Strategy

Research & discovery

We started by talking to teams across the business to understand what members struggled with and where the website was falling short.

Stakeholder workshops

5 sessions with marketing, lending, and support

Mapped business goals and success measures

Identified early friction in content governance and IA

🧠 Actionable insights

Teams were aligned on growth goals but had competing content priorities

Needed a single view of the member journey to align language and goals

Conflicting naming conventions created confusion in navigation

Needed a single view of the member journey to align language and goals

Member workshops

3 sessions in Adelaide and Melbourne

ix of new and long-term members, ages 25–65

Tasks focused on finding loan rates, calculators, and support info

🧠 Actionable insights

Members searched by goal (“buying a home,” “saving money”) not by product

Content tone felt impersonal and overly formal

Loan calculators were the first step in most journeys

Members expected to see quick comparisons and clearer next steps

IA testing (Treejack)

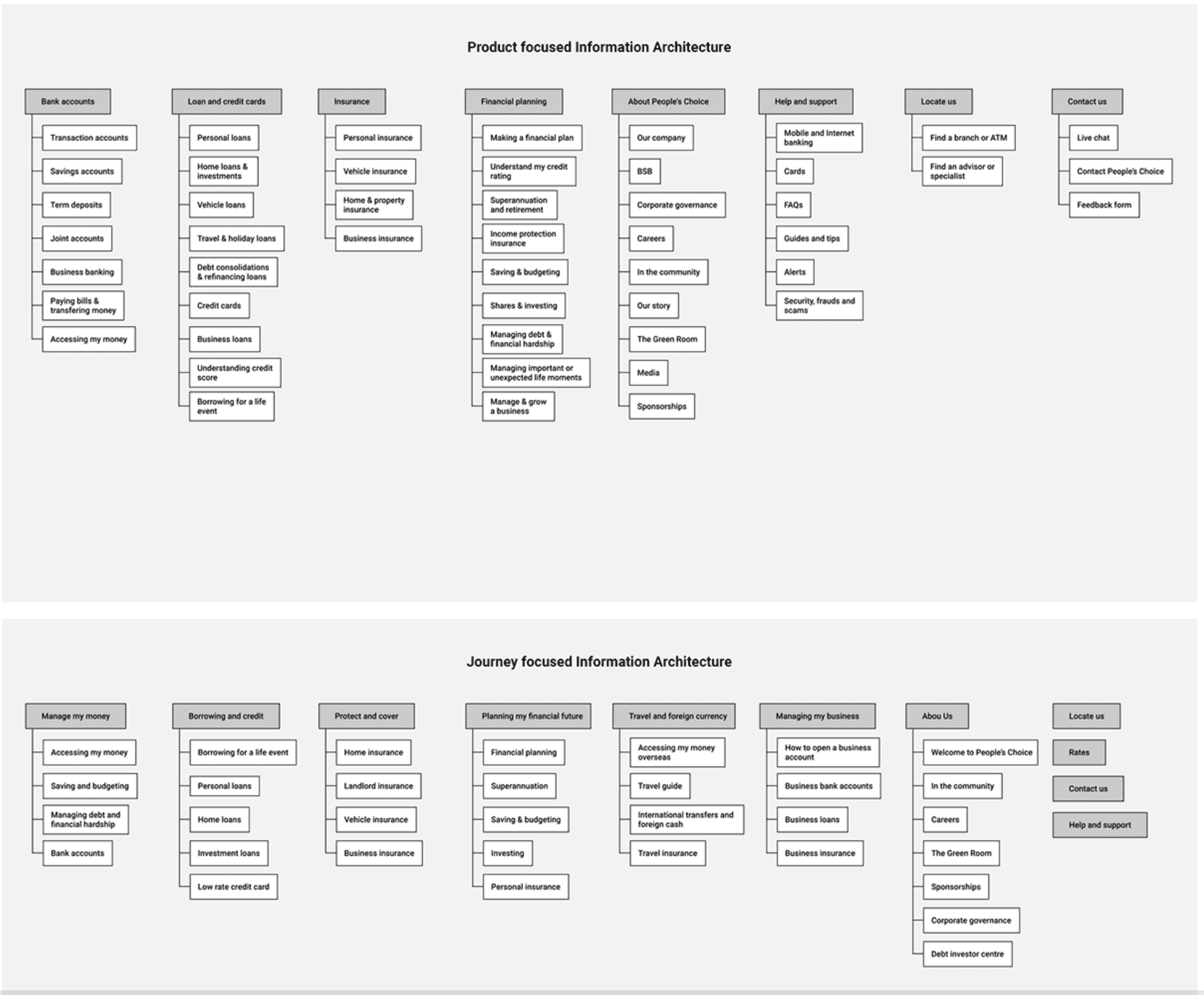

Compared product-based vs journey-based structures

Product-based IA — organised around traditional banking categories like “Loans,” “Accounts,” “Insurance.”

Journey-based IA — organised around real member goals such as “My Home,” “My Everyday Banking,” and “My Future.”

25 participants including staff, members, and non-members

Used quantitative Treejack data plus qualitative follow-ups

📊 Results

Journey IA: 78% task success

Participants described journey labels as “more natural” and “human”

Product IA: 63% task success

Suggested adding shortcuts for tools like calculators and rates

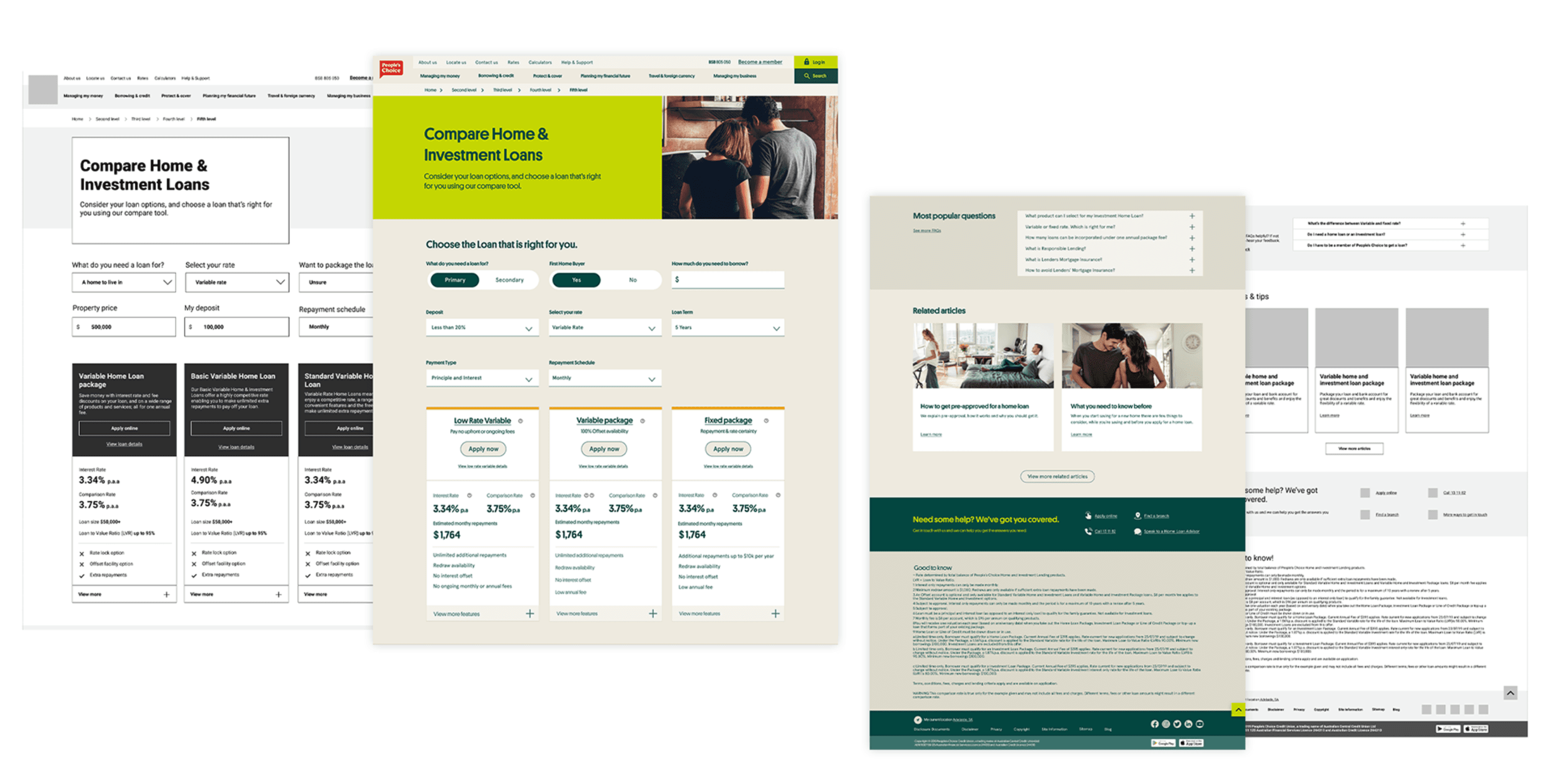

Design & testing

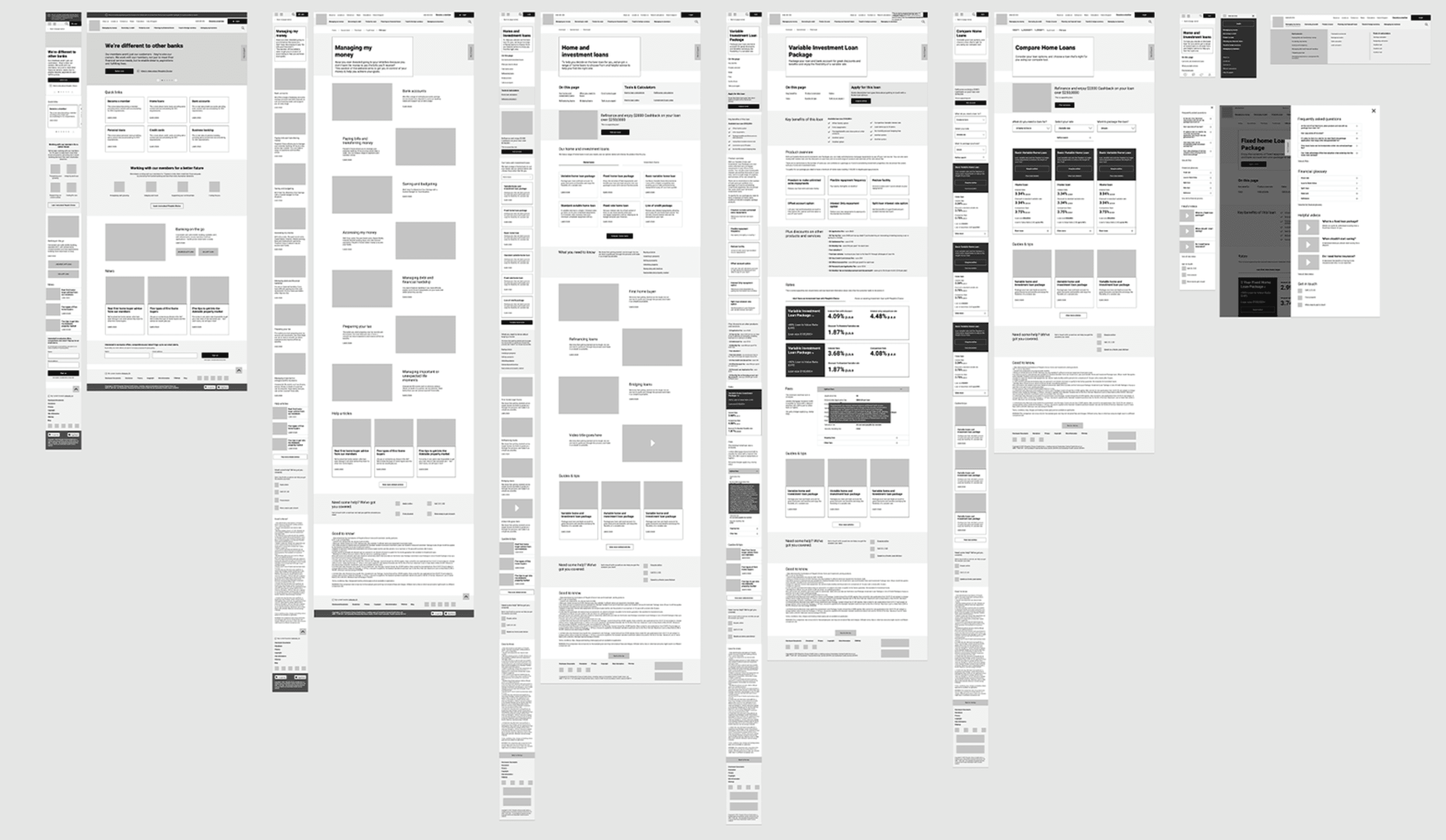

We took the research findings into wireframes and interactive prototypes across desktop and mobile.

Usability testing

Two rounds with members and internal staff

Round 1 focused on navigation and hierarchy

Round 2 tested key tasks like finding rates and using calculators

Prototypes were kept low-fidelity to focus on structure, not visuals

🧠 Actionable insights

Secondary menus were overwhelming and repetitive

Some terminology confused non-members (“offset,” “variable”)

Rates and calculators were too hidden in navigation

Plain-language labels improved task confidence and success rates

📊 Iteration results

Task success improved from 68% to 85% after refinements

Drop-off rate reduced by about 30% on key pages

Navigation time shortened by roughly 25% across journeys

Design Refinment

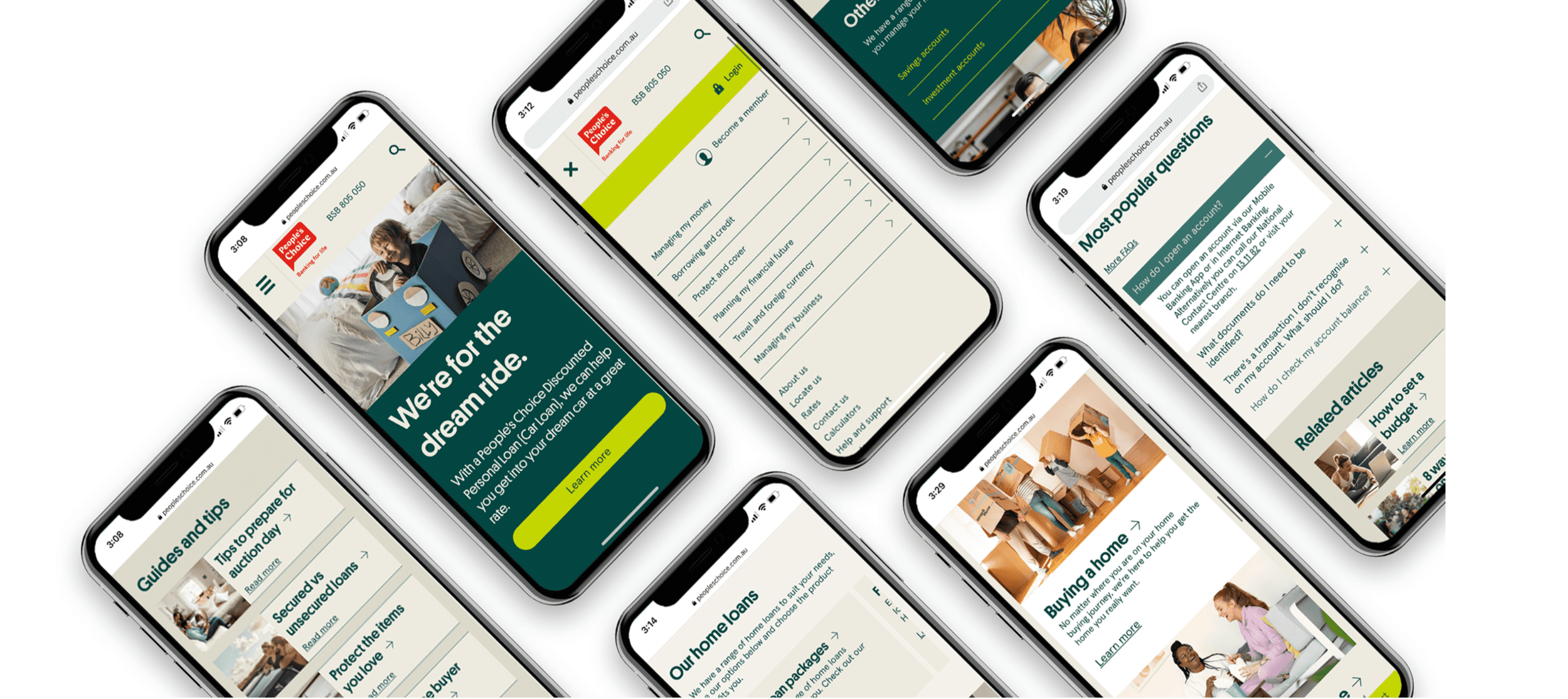

Simplified navigation labels using real-world language

Elevated calculators and key tools in the hierarchy

Introduced global search and clearer CTAs for high-intent tasks

Created flexible templates that scaled across product lines

🧠 Actionable insights

Members valued clear next steps over marketing copy

Accessibility reviews highlighted colour contrast and touch targets

Consistent structure improved confidence across devices

Iterative testing helped align design, marketing, and tech decisions

Outcome

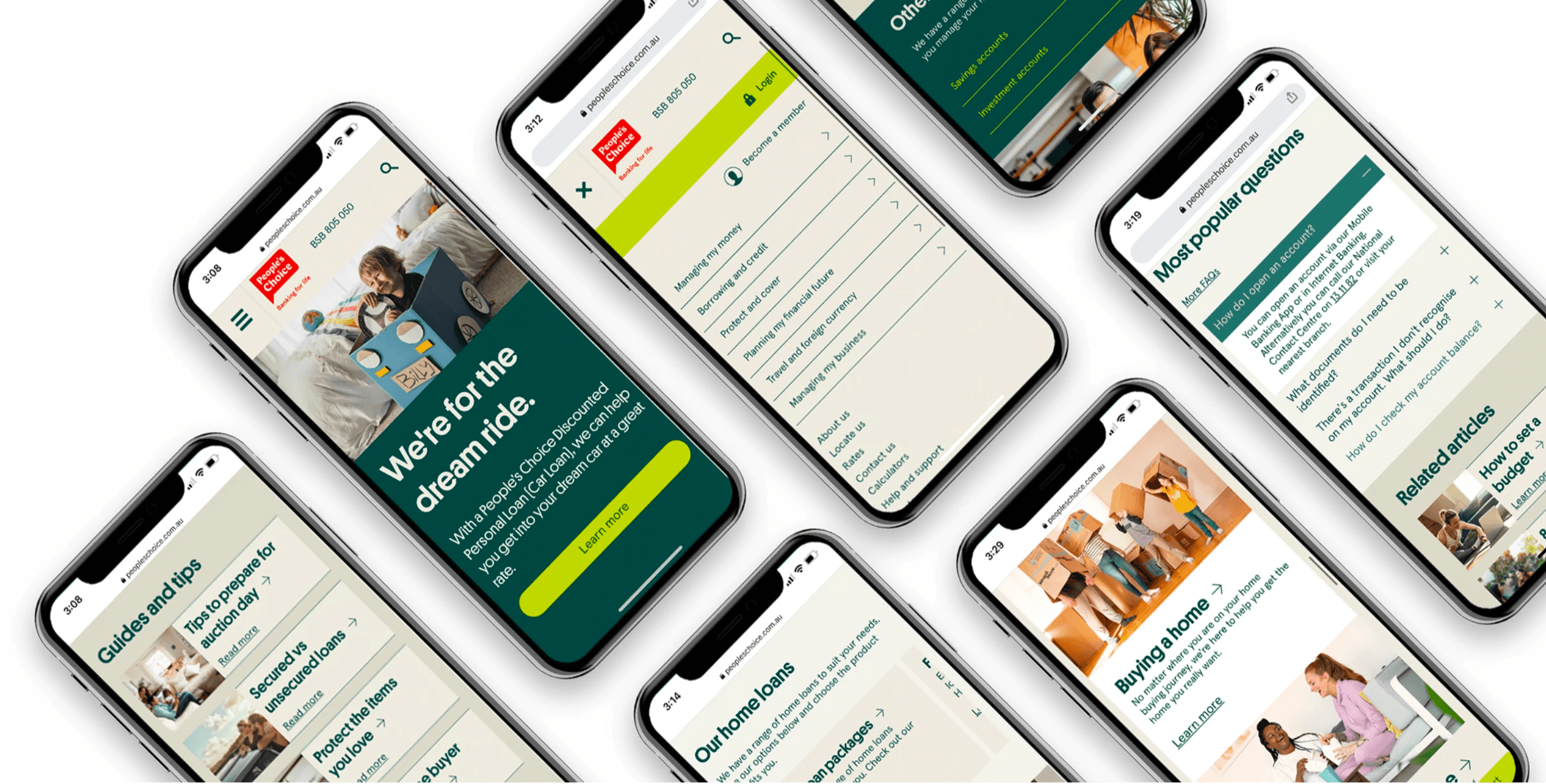

The new site launched in 2021. It’s fully responsive, easier to navigate, and designed around real member goals instead of internal structures.

📊 Results

Bounce rate down 22 %

Average session time up 30 %

Calculator usage roughly doubled

Mobile traffic grew from 38 % to 56 %

🧠 Key takeaways

Journey-based IA reduced friction and improved discoverability

Testing turned subjective debates into data-driven decisions

Internal teams could now manage content directly through the CMS

The new design built trust and consistency across digital channels