From early product to global architecture

Debt collection is conventionally seen as adversarial, with customers experiencing stress and confusion while businesses face inefficiencies, high support burdens, and low recovery rates.

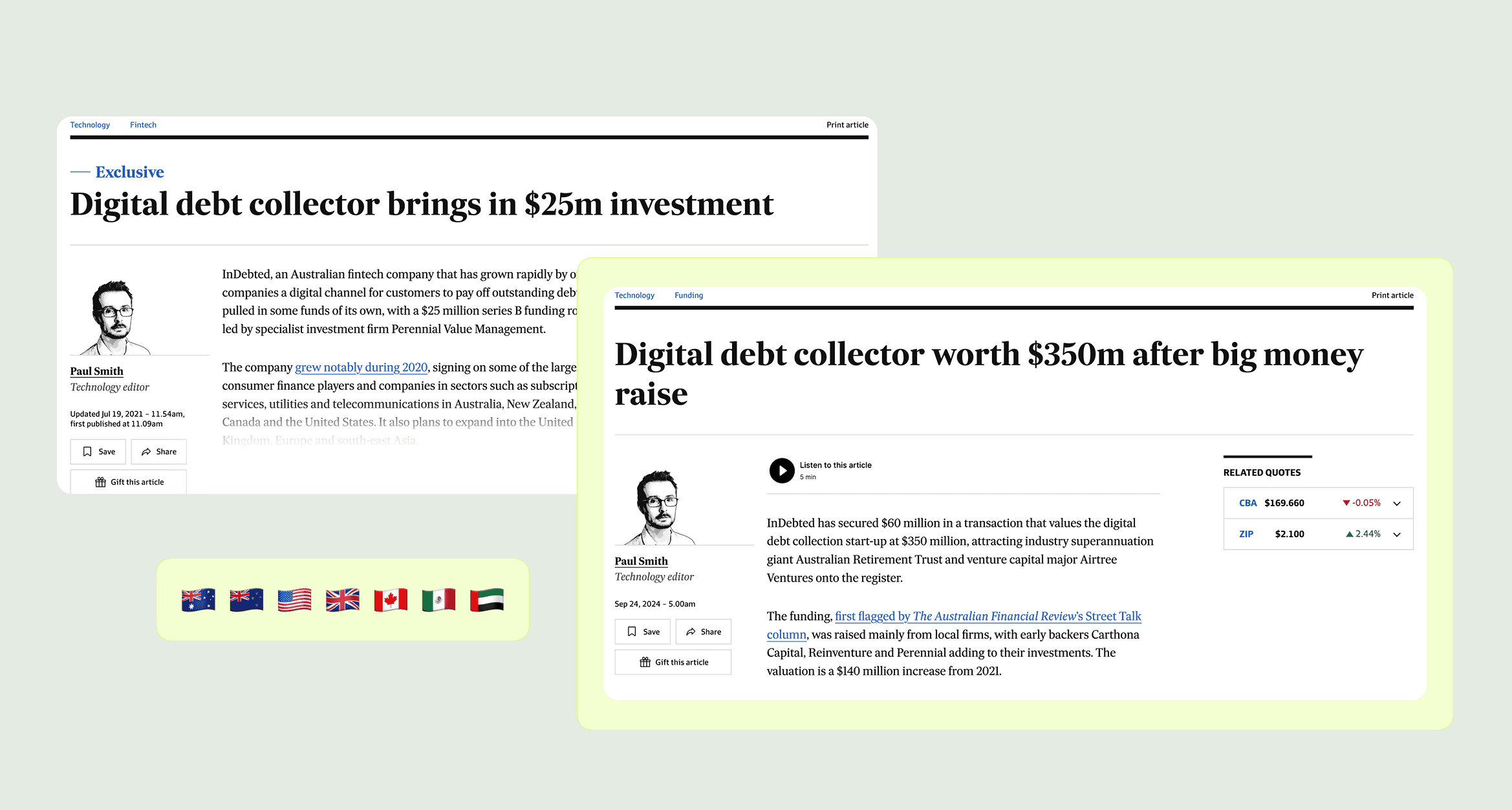

At InDebted, as we scaled globally after our Series B, we needed to become more operationally efficient and move towards profitability. Payment plans, our largest revenue driver but also the weakest link, became the natural focus, and by simplifying the plan setup and reducing friction across the lifecycle, we could unlock growth, improve client retention, and position the business for a sustainable Series C.

Some of InDebted clients

Challenge

With $117M locked in active plans but only 9% successfully completed, the challenge was to transform payment plans from a leaky funnel into a true growth engine. The founder’s mandate was clear: scale sustainably, not just fast, by improving gross margins, growing revenue, and enabling market expansion all at once. Through qualitative analysis we confirmed that tackling the full payment plan lifecycle would move the levers, since plan setup, transparency, and recovery directly influenced completion rates.

My role

I worked as a Hybrid Product Designer, leading the project end to end and bridging compliance, engineering, and stakeholders. I conducted 15 customer interviews across AU and US, framed problems with the Head of Product, and translated insights into product direction. Starting with support ticket analysis, I carried the work through discovery, design, and delivery in close partnership with engineers, always keeping key KPIs front of mind.

✔️ Research (Qual + Quant) | ✔️ User Interface | ✔️ AI Prototyping | ✔️ Design System | ✔️ Product Strategy

Research & discovery

To understand where payment plans were breaking down, we combined qualitative and quantitative research and we focus on 2 key areas of payment plan:

Customer interview

Moderated interviews (8 AU, 7 US)

45 minutes session

Balance between $50 to $250

30 to 90 days aged accounts

Afterpay and Klarna customers (BNPL)

Customers currently on payment plans

🧠 Actionable insights

Budget-first

Customers set plans around living expenses, not duration.

Cognitive overload

Too many steps and unclear info → backtracking.

Trust and control

Customers wanted clear obligations and self-service flexibility.

Support ticket research + Journey mapping

We went straight to customer support data, looking at what people were asking for help with. If customers kept reaching out, that meant friction in the product.

The support team used 19 different tags to categorise requests. A few of them stood out as clear opportunities.

🧠 Actionable insights

Payment Plan Details

2.7% of support requests. Low but with a high agent handling time.

Resolve payment plan

Low (below 0.5%) but withhigh agent handling time and high potential for account resolution ($$$)

Failed payment request

Below 0.5%. High opportunity to tap into revenue without increase gross margins.

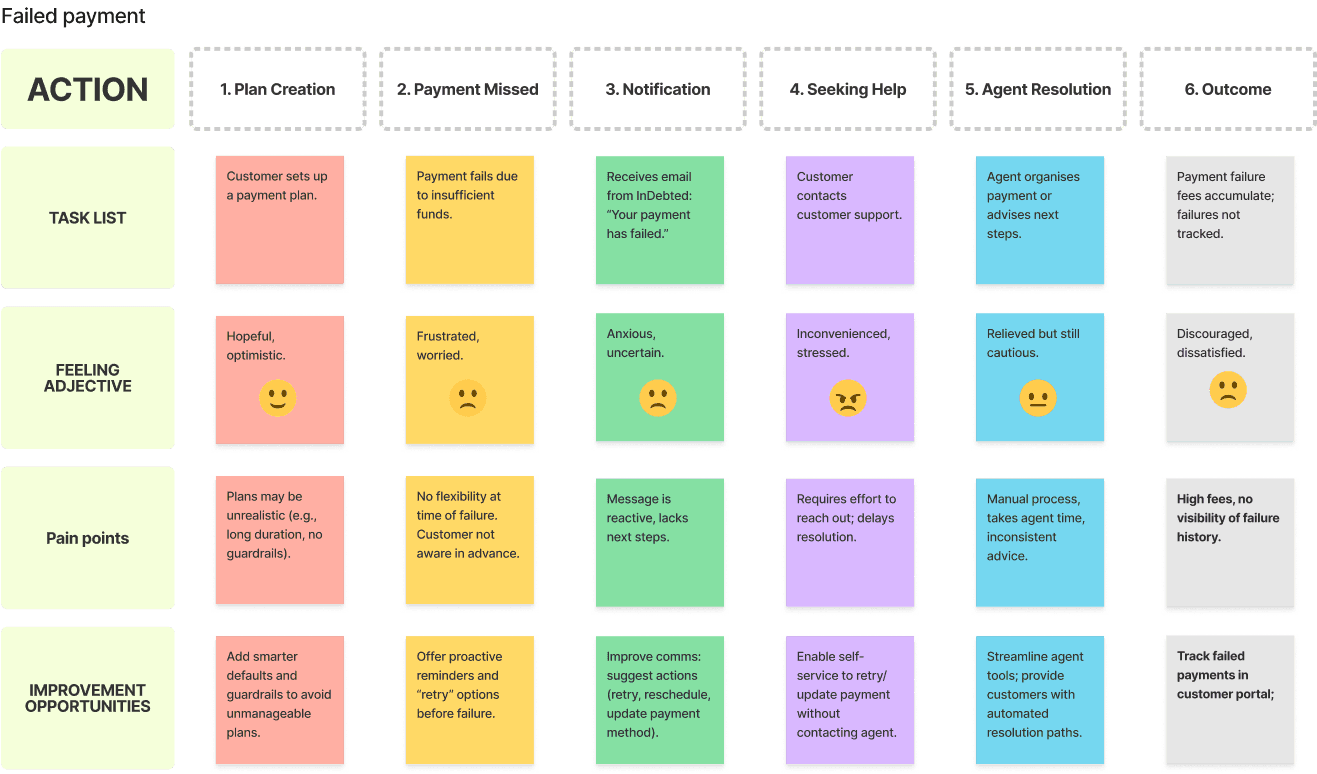

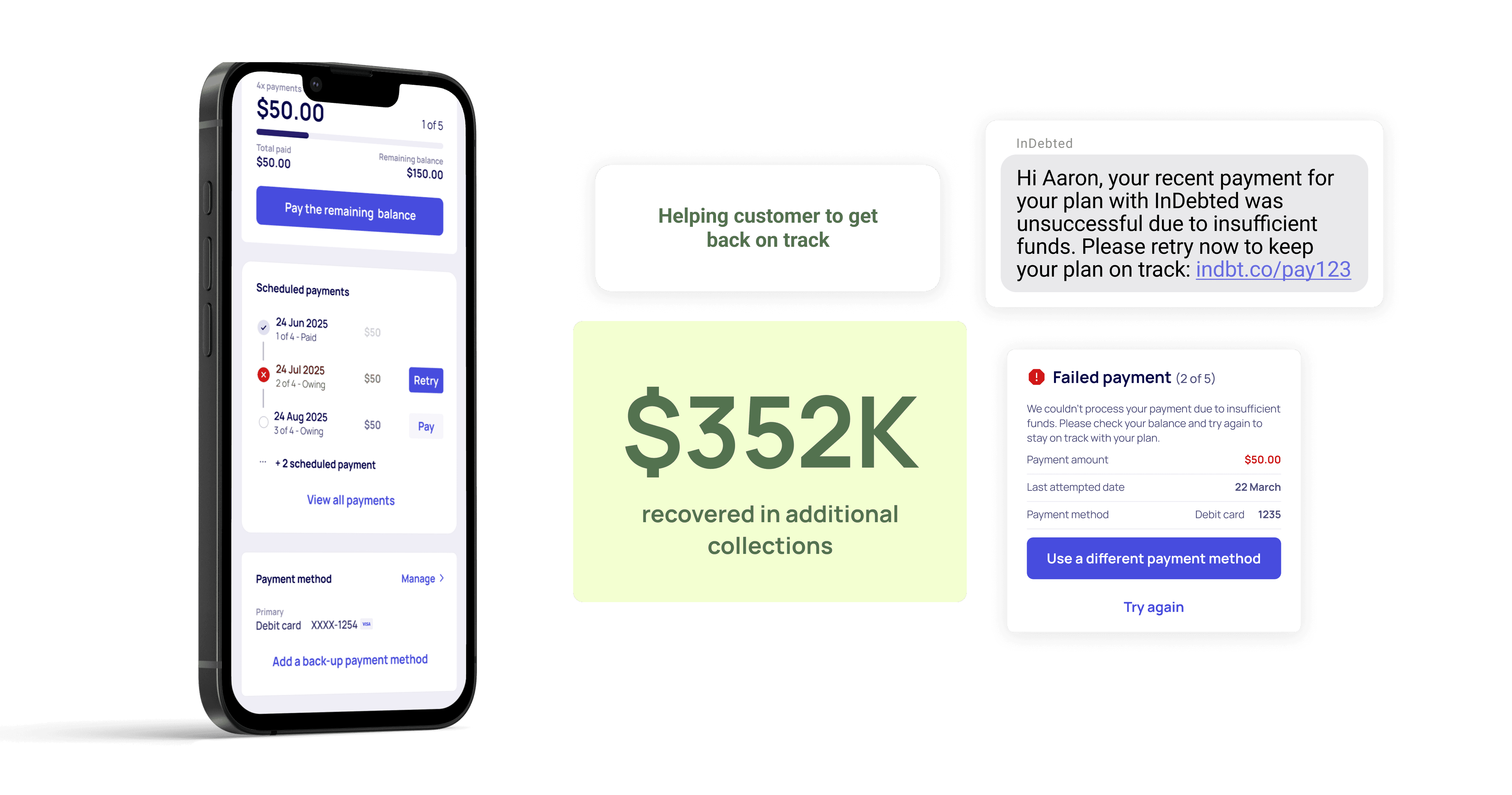

Journey mapping (Failed payments)

we interviewed five customers who had recently experienced failed payments and mapped their journeys. Most only learned of the issue through an email and, with no self-service options, felt stuck and turned to support. This created friction for both customers and agents, showing clear opportunities to reduce stress and build trust through proactive nudging and self-service recovery.

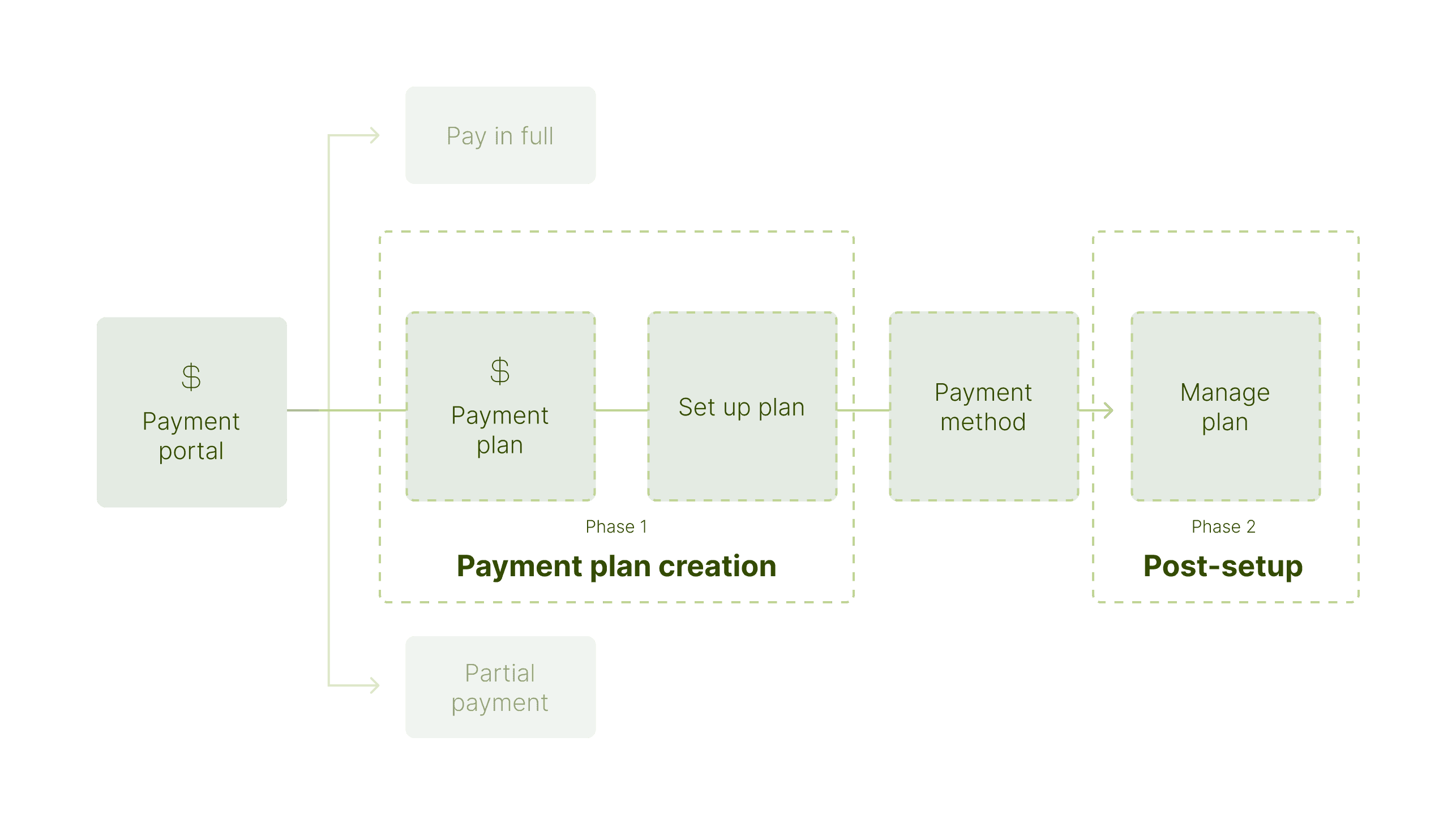

Delivery

We structured delivery into two key phases, reflecting the customer journey from creation to management of payment plans.

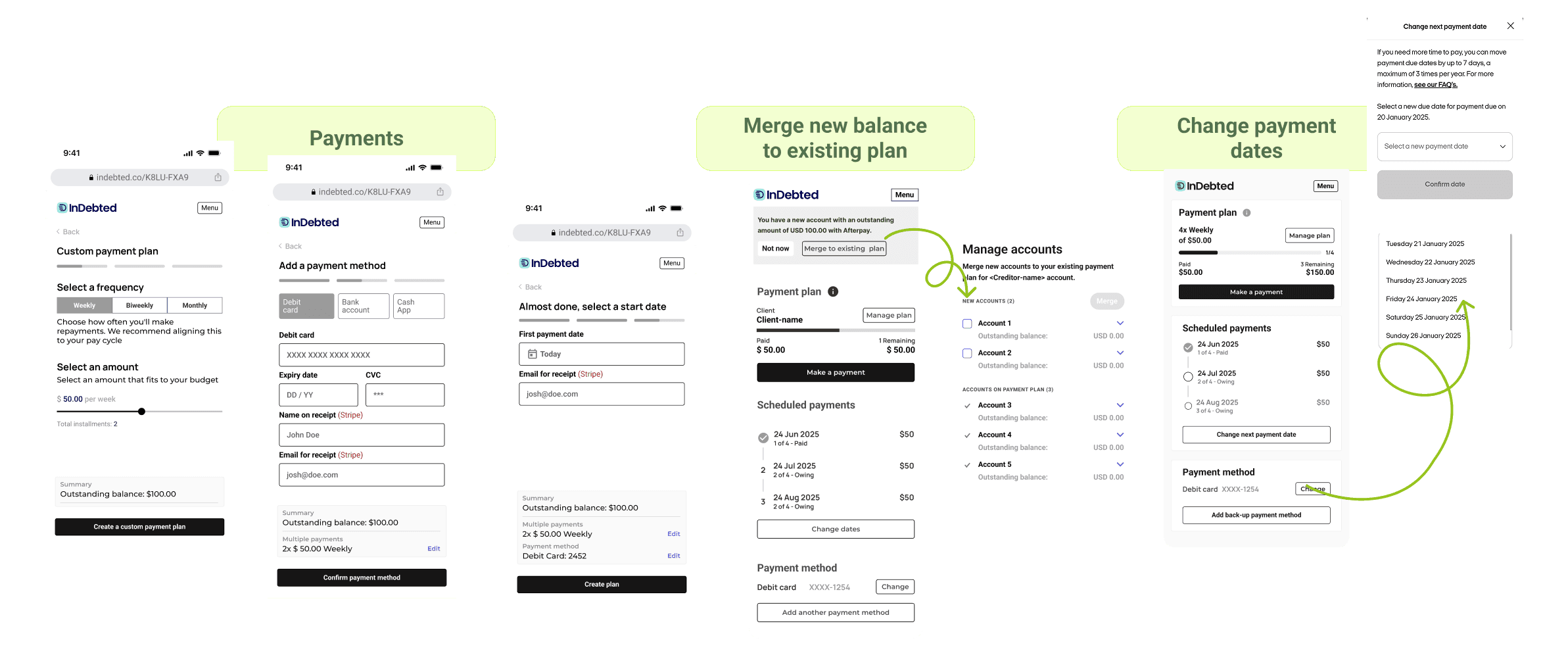

Phase 1: Payment Plan Creation

Focused on simplifying setup by reducing steps, aligning plans to customer budgets, and creating a single-screen flow that made choices clear and predictable.

Phase 2: Post-Setup

Addressed ongoing pain points by improving transparency, enabling plan management in one place, and building self-service recovery for failed payments through nudges and retry flows.

This phased approach ensured we tackled the full lifecycle from helping customers set up plans with confidence to supporting them when things went wrong.

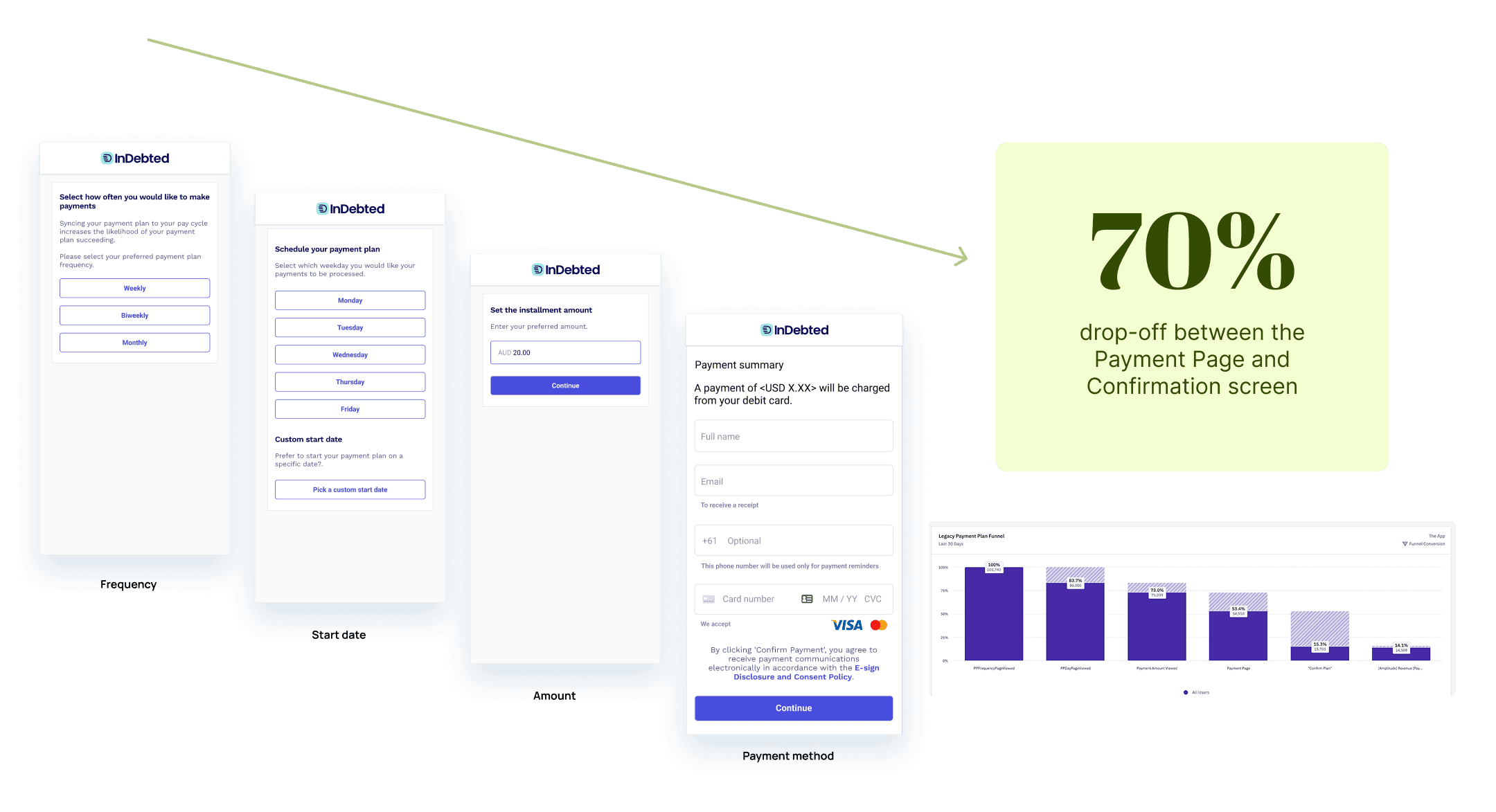

Phase 1 | Payment plan creation

Where the current flow falls short

By analysing customer behaviour and UI patterns, we identified key opportunities to improve the plan setup flow:

Guardrails: Some customers created plans lasting over 19 years, highlighting the need for clearer limits.

Flow complexity: Amplitude showed drop-off was driven by too many steps in the journey.

Backtracking: Customers frequently clicked back and forth, trying different amounts and frequencies a sign the UI wasn’t guiding them effectively.

Learning from MVP

The first release had to cut critical elements like toggles, sliders, and upfront summaries. While it simplified delivery, these tradeoffs limited the impact and the metrics didn’t shift as expected. This highlighted the importance of balancing feasibility with user needs even small compromises in control and clarity can blunt adoption.

Alignment & Architecture Reset

The MVP showed UX fixes weren’t enough. Through cross-functional workshops, we:

Clarified client, regulator, and customer needs

Prioritised constraints blocking growth

Aligned on a north star vision for scalable payments

🎩 Product manager hat

I partnered with a Staff Engineer and an Engineering Manager, backed by the CPO, to ensure we built a solution that was future-proof and aligned with both client and customer needs. Without this, the existing limitations would have continued to slow growth, block scaling into new regions.

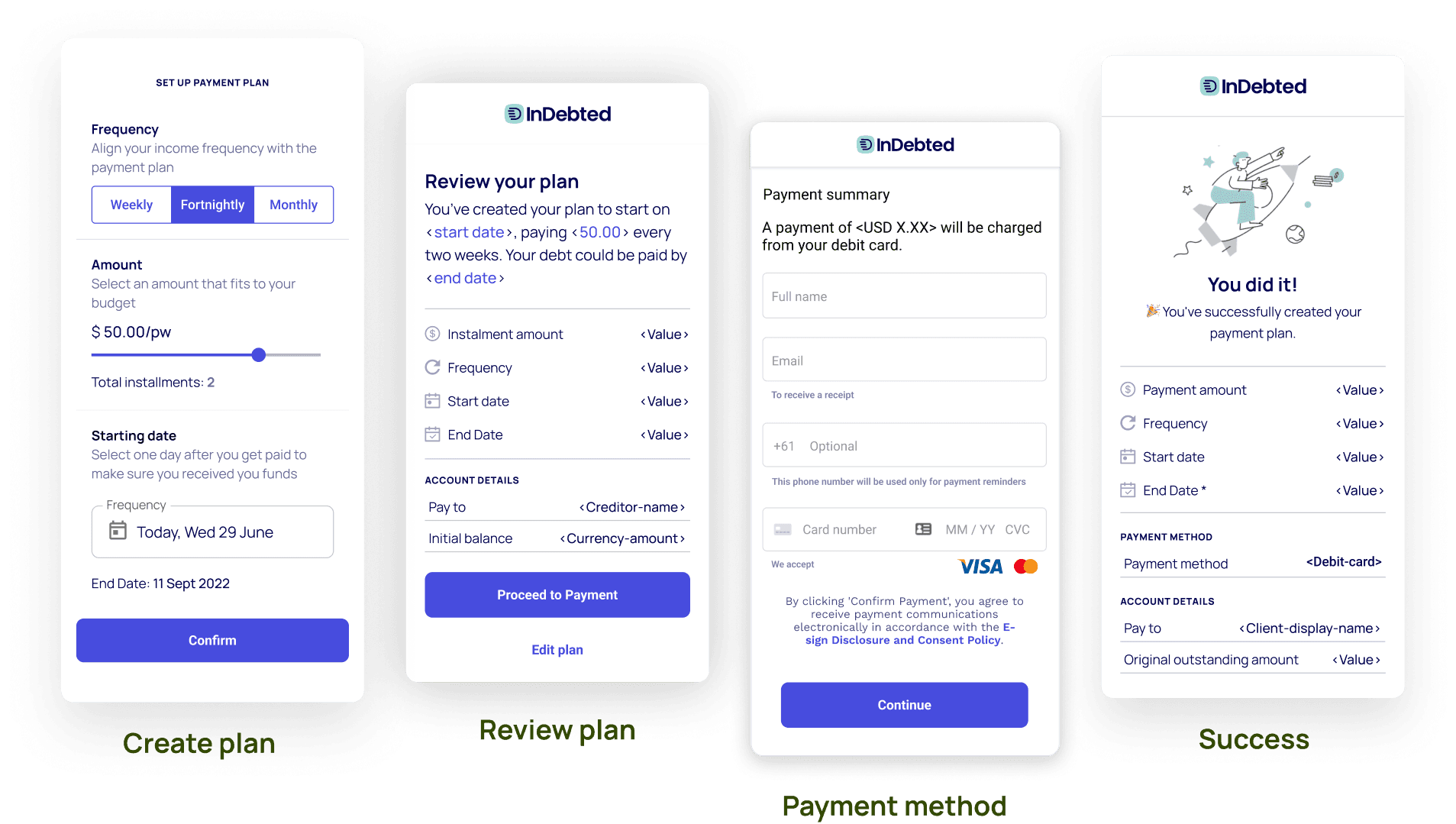

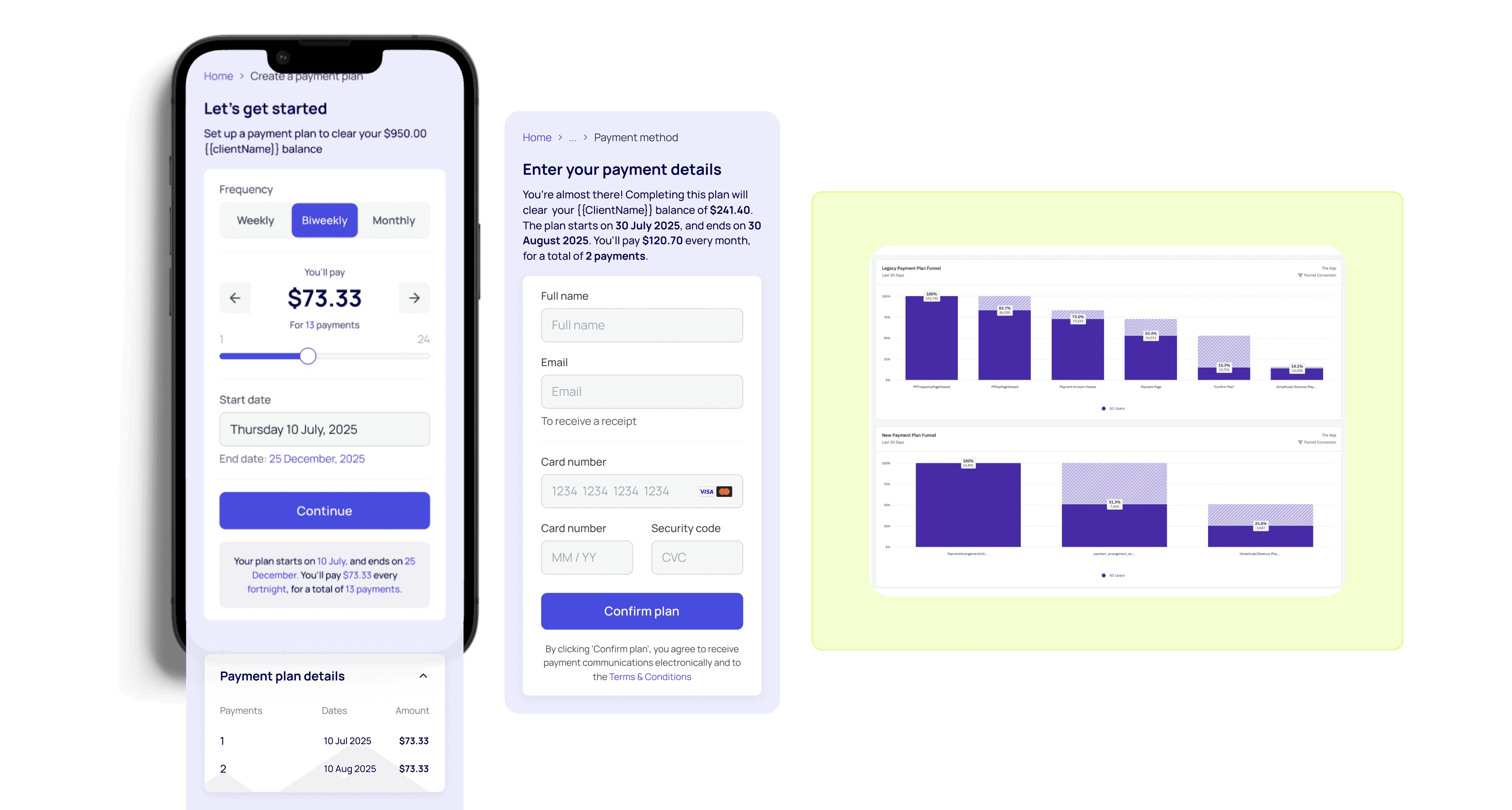

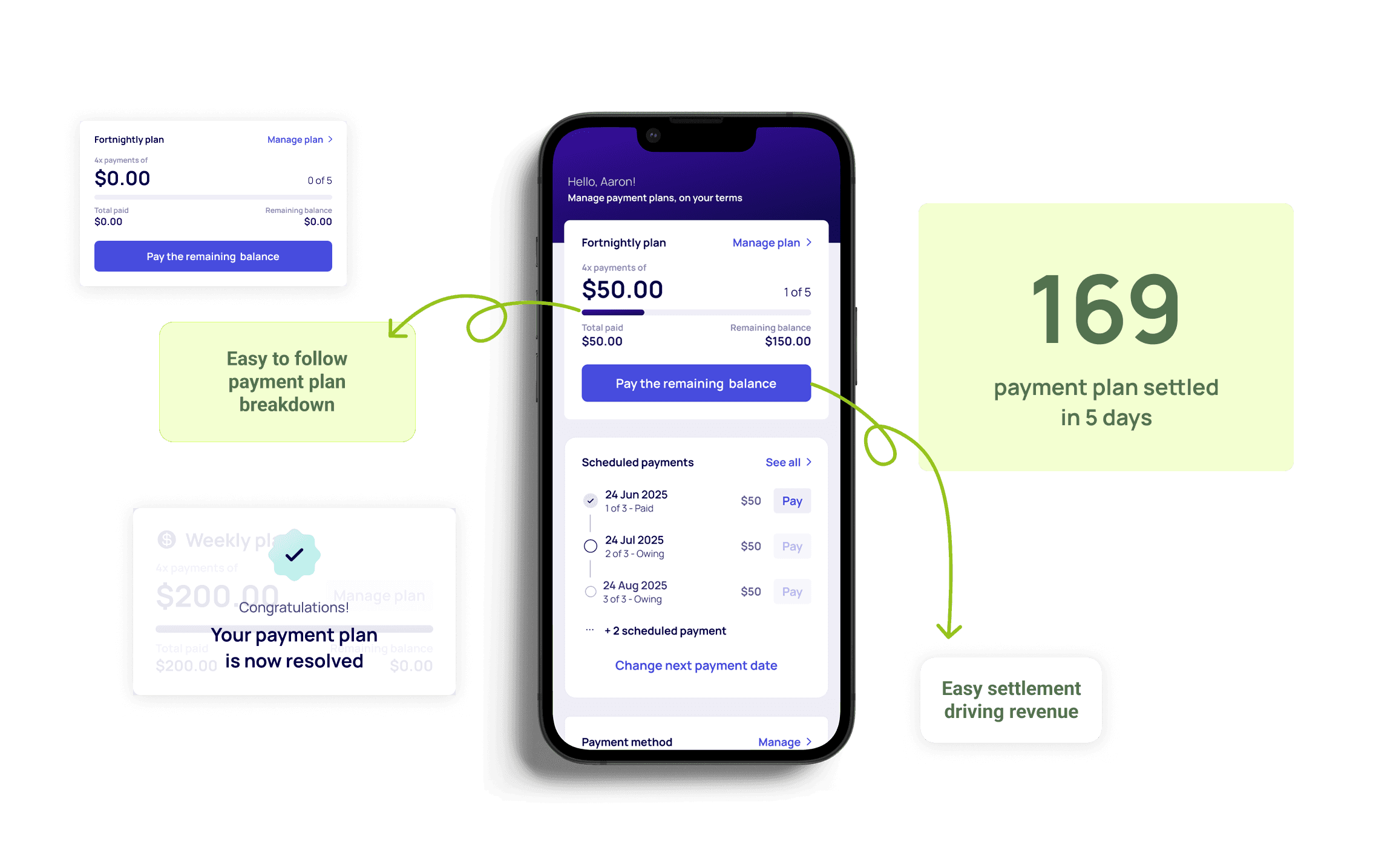

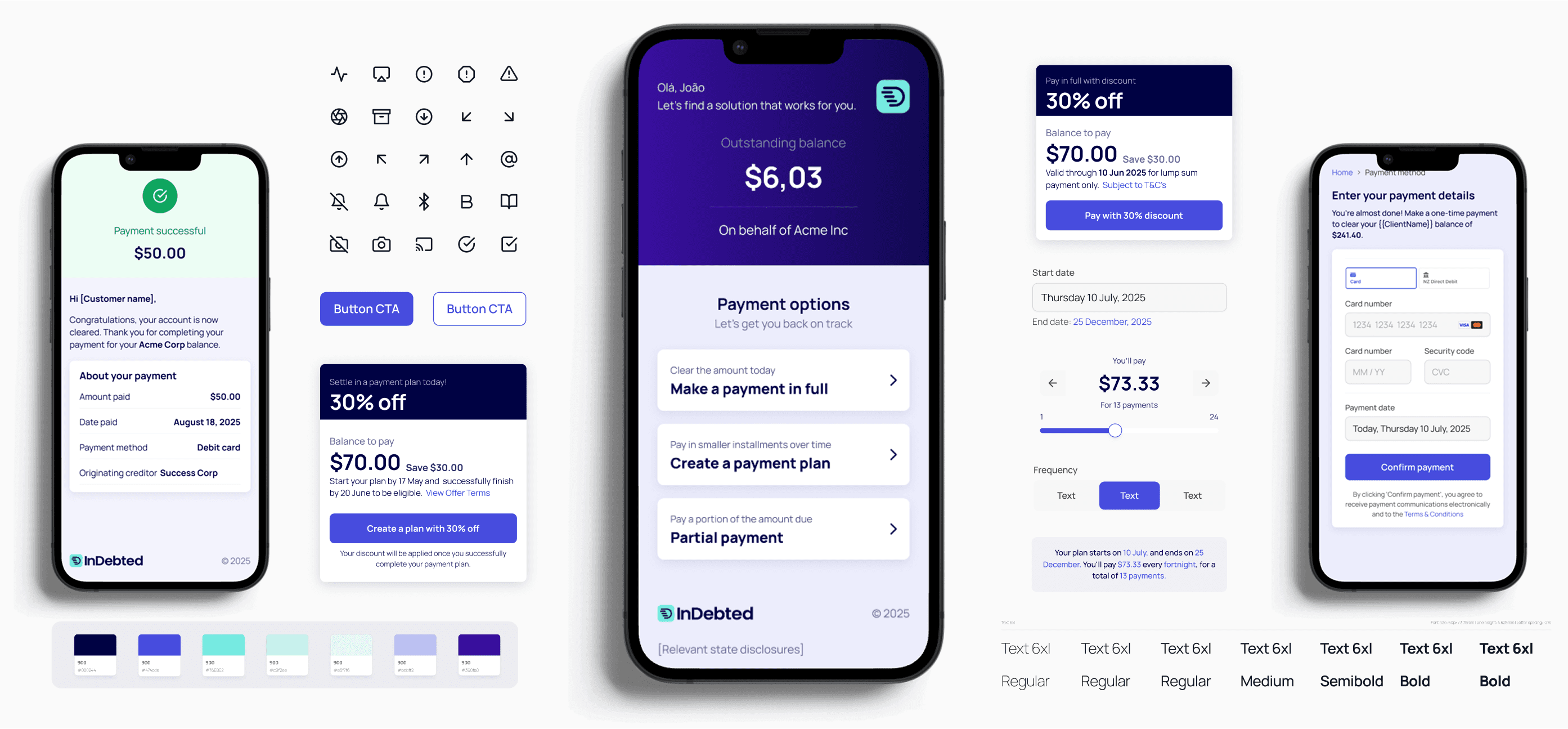

New Payment Plan & Rebrand

Once the new architecture was live and the front end modernised, we enhanced the payment plan experience itself.

We redesigned the flow into a single-screen experience where customers could select and confirm their plan in one place plus updating inDebted brand uplift.

This simplified the journey and reduced friction.

For first-time users, it could feel overwhelming, but we tracked success and key metrics to balance simplicity with usability.

New payment plan results

30%

Revenue increase in 1 month

uplift in overall conversion

A/B test

Markets that we first shipped

🇳🇿 🇨🇦 🇲🇽 🇦🇪

Conversion

Old: 14.1% conversion (14,508 of 102,740)

New: 25.8% conversion (3,847 of 14,891)

Average Recovery time

Old: 175 days

New: 58 days

Max Recovery time

Old: 7063 days (19+ years)

New: 487 days

Average instalment

Old: $66.35

New: $72.40

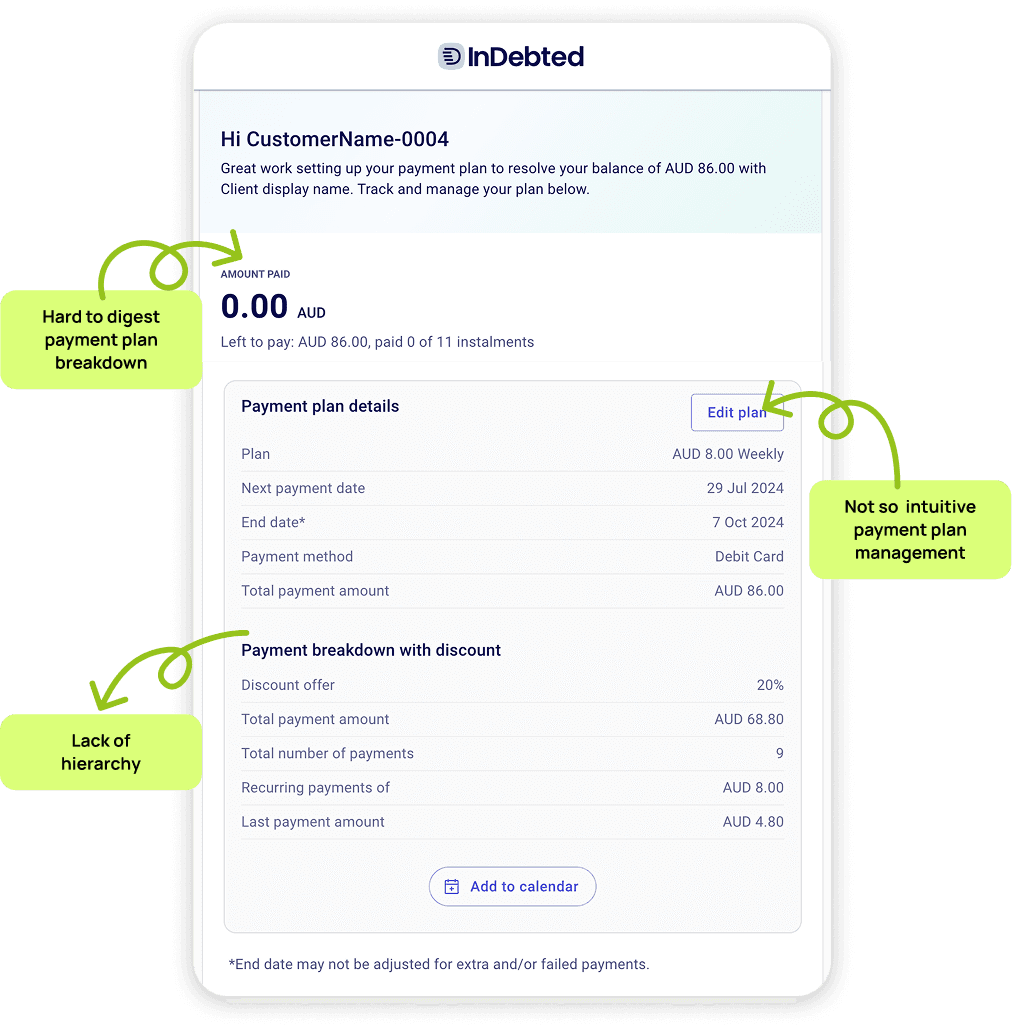

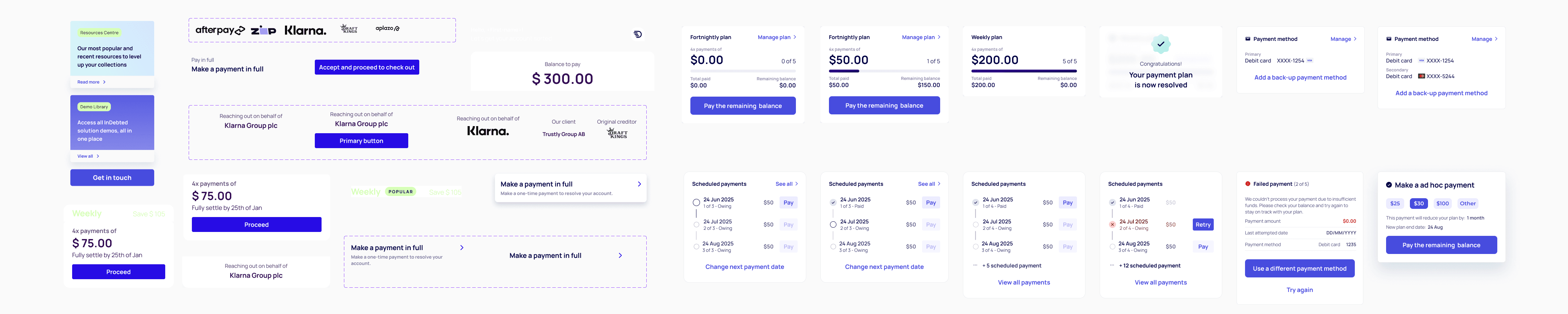

Phase 2 | Post-Setup

Design analysis and exploration

The product was still in MVP state, with plenty of ideas on the table the challenge was focusing on the most impactful improvements first.

I worked closely with compliance and kept stakeholders engaged throughout.

Manage failed payments results

We introduced a customer-initiated retry button, supported by clear email and SMS nudges explaining the failure reason, so customers could retry instantly in-app without needing Customer Support.

$352k unlocked by new failed payment feature

82% success rate on retried payments (gross margins impact)

Total of 9.3K retry attempts

Majority retried within 24 hours

Reduced plan cancellations and CS contact

Global design system

I built a scalable design system at InDebted that supported multiple markets and languages, balancing consistency with localisation. Components were designed to adapt to regional regulations, currencies, and right-to-left scripts, enabling faster delivery while ensuring compliance and trust across the US, UK, AU/NZ, Canada, UAE, and LATAM.

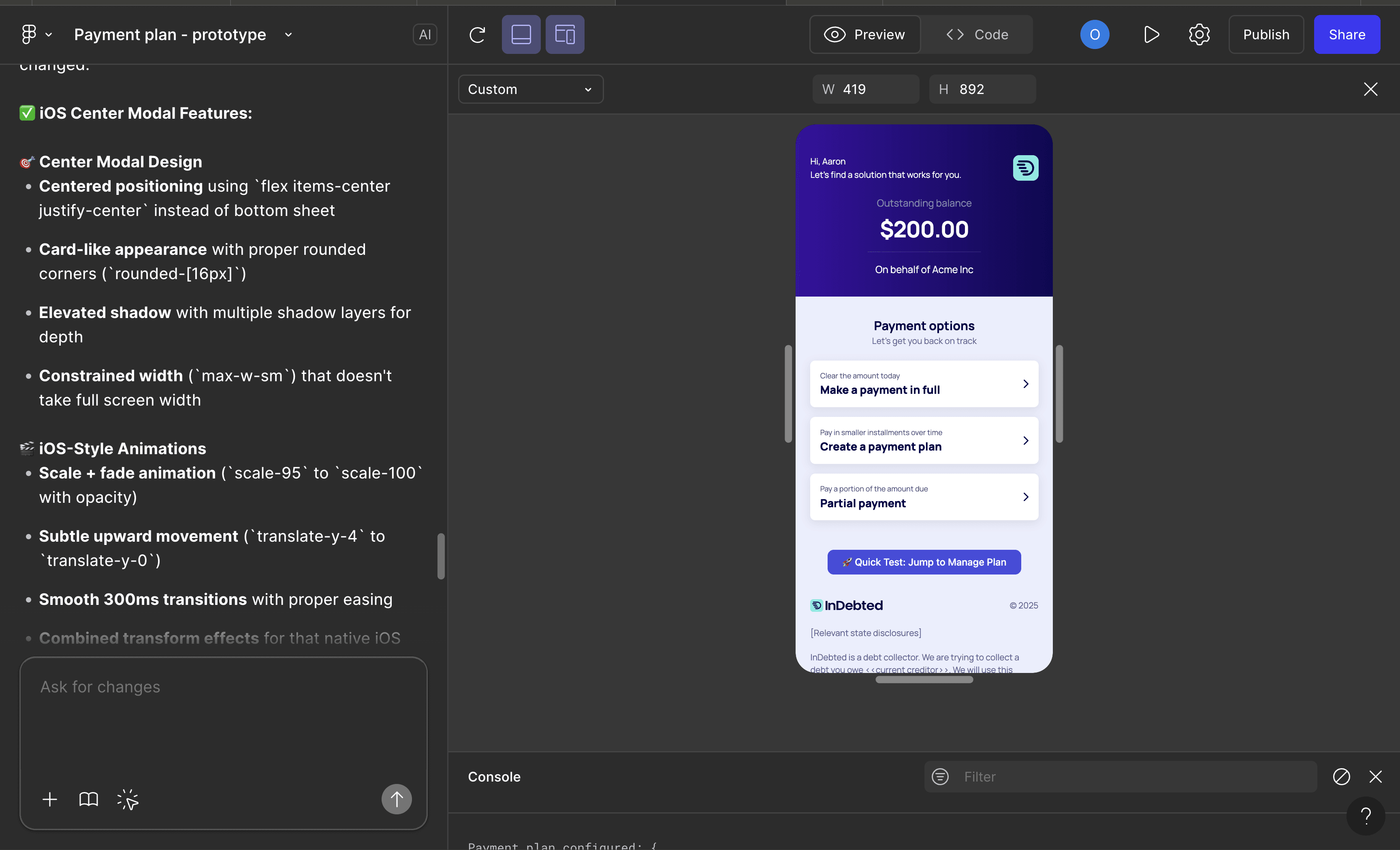

Rapid prototyping using Figma Make

This project was one of several key initiatives that helped the business secure multiple successful funding rounds, driving its valuation from $140M to $350M.