Scaling collection with research

Role

Product Designer

Company

InDebted

Type

Research, UX, UI

Impact

$352k recovered

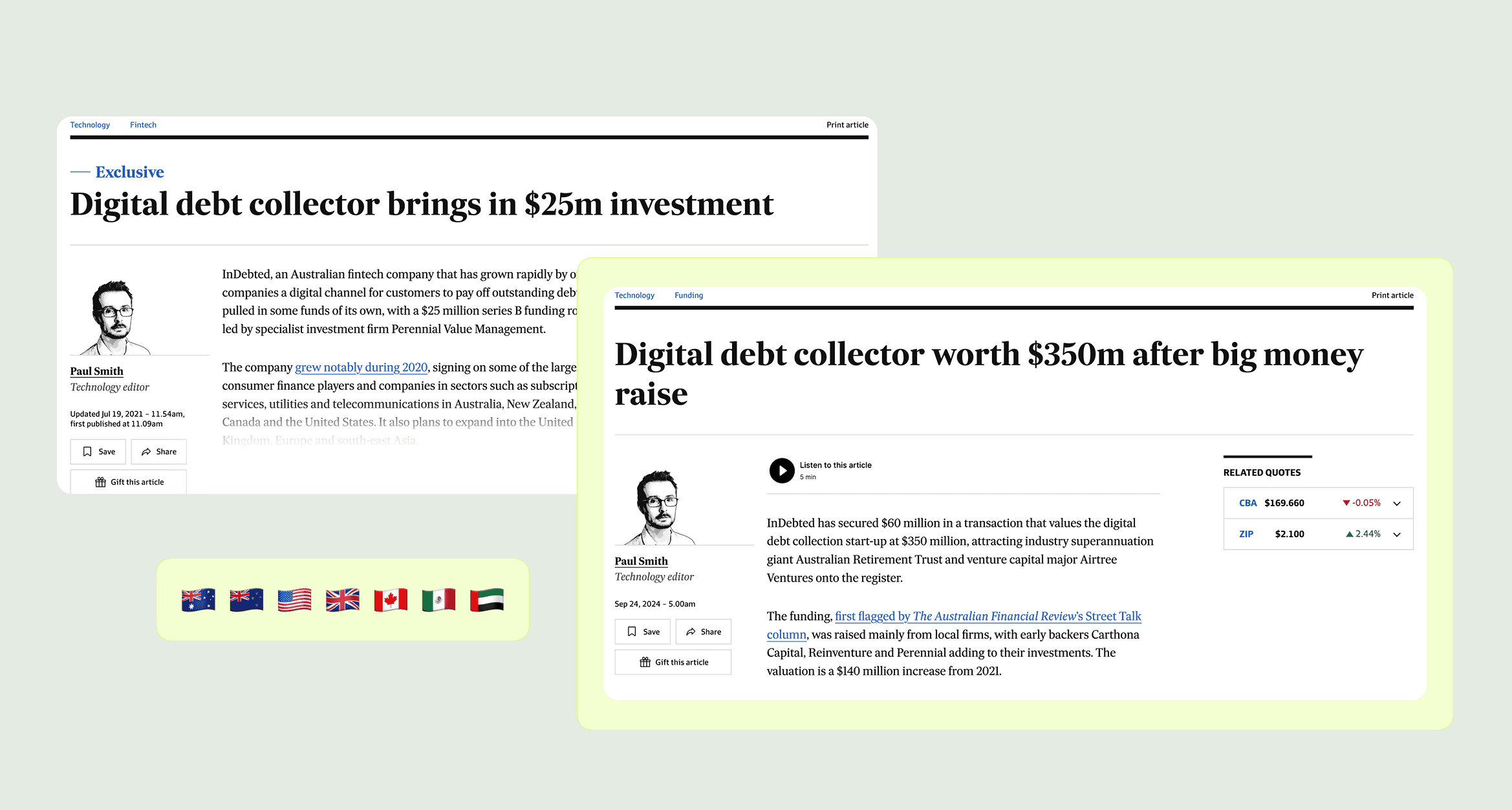

After raising its second funding round (Series B), InDebted went through a big hiring phase and needed to become more operationally efficient. The focus was on moving towards profitability by improving product efficiency and client satisfaction so the business could keep scaling and position itself for a sustainable Series C.

Some of our clients

Challenge

The founder’s mandate was clear: scale sustainably, not just fast. That meant improving gross margins, growing revenue, and enabling market expansion, all at the same time.

My role

I started by partnering with a Product Manager to dig into customer support tickets and spot opportunities to improve the product while keeping key KPIs in mind.

Halfway through, the Product Manager left the business. From there, I stepped in to carry some of their responsibilities working directly with engineers and stakeholders, and balancing both the design and product side of the work.

🔍

Research approach

We split the research into two phases:

Customer requests: Analysed support data to spot recurring issues — repeated requests signalled product friction.

Deep dive: Focused on the most frequent tags for richer insights.

Phase 1: Customer support analysis

We went straight to customer support data, looking at what people were asking for help with. If customers kept reaching out, that meant friction in the product.

The support team used 19 different tags to categorise requests. A few of them stood out as clear opportunities.

Phase 2: Drilling down the problem space

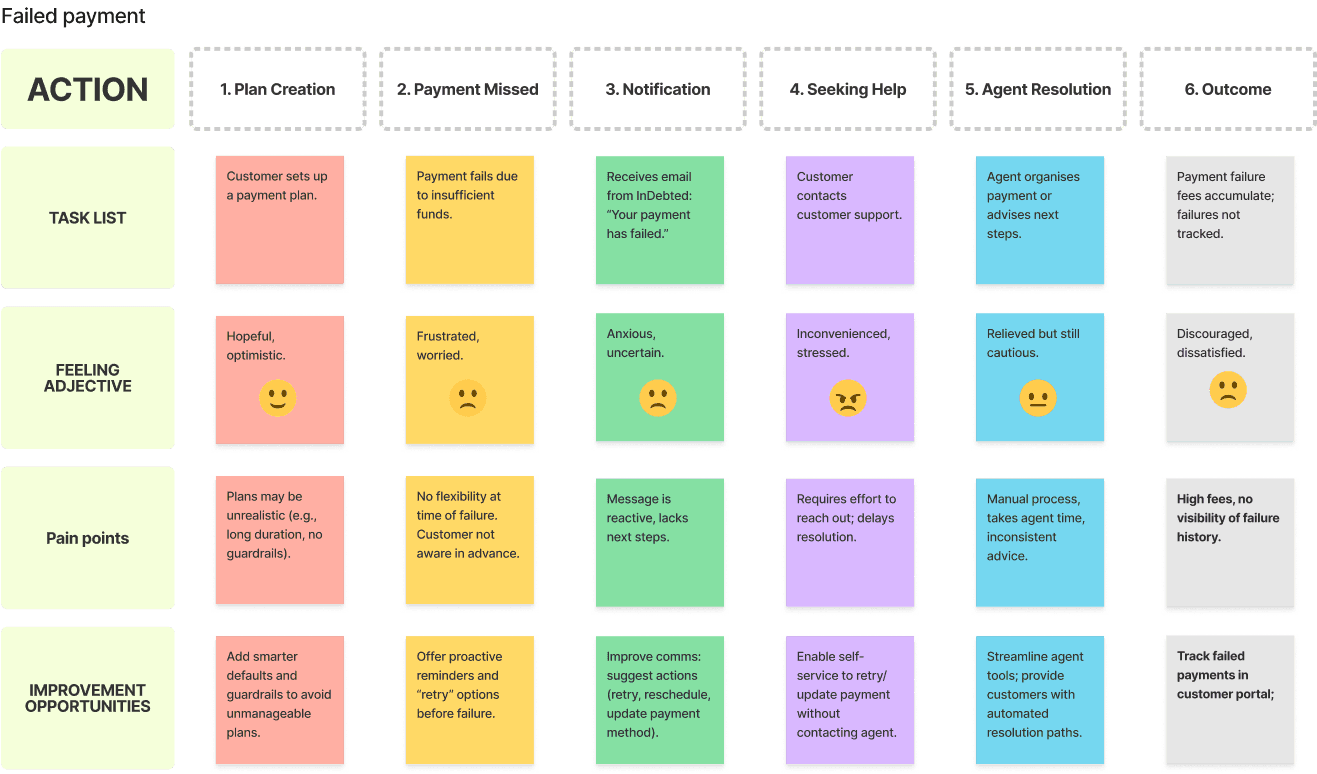

We interviewed five customers who had recently experienced failed payments and mapped their journeys in 30-minute workshops. Most only discovered the failure when they received an email from InDebted and were unsure what to do next. With no clear self-service options, they felt stuck and turned to support, highlighting clear opportunities to reduce friction and build trust.

Key areas to improve

Both customers and agents experience friction.

Lack of tracking, transparency, and guardrails creates financial and emotional stress.

High opportunity to shift to proactive nudging and self-service recovery.

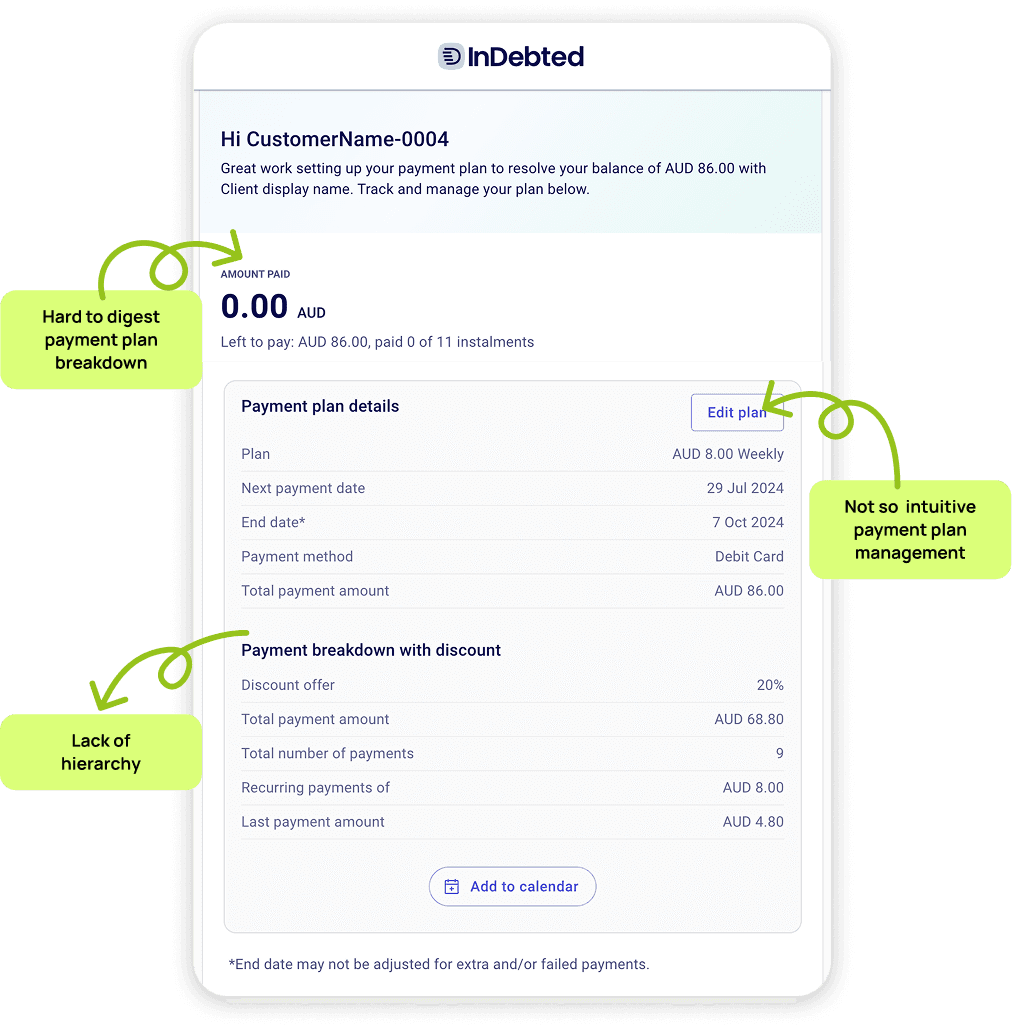

Design analysis and exploration

Having designed the original MVP, I already knew its trade-offs and limitations, which helped me quickly spot opportunities to improve.

I worked closely with compliance and kept stakeholders engaged throughout.

The product was still in MVP state, with plenty of ideas on the table the challenge was focusing on the most impactful improvements first.

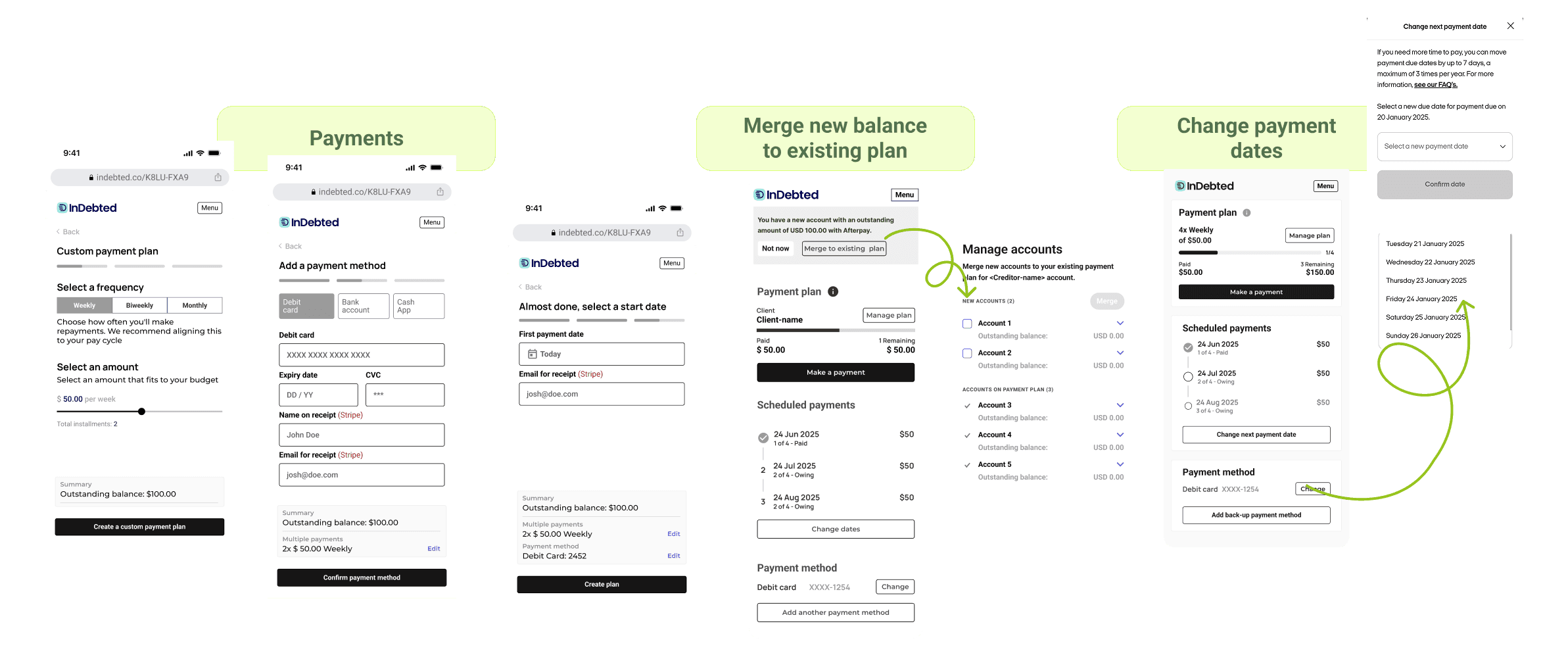

Unlocking New Capabilities

Once the new architecture was in place, we could finally build features the old system could never support. This wasn’t just a UX update it was a future-proof foundation that unlocked entirely new ways for customers to manage payments and for clients to recover faster.

New capabilities included:

Tiered settlements – breaking down large balances into structured tiers

“Promise to pay” arrangements – scheduling one-off commitments without a full plan

Abandoned cart recovery – re-engaging customers who didn’t finish setup

Discounts & flash sales – offering time-bound incentives safely

Flexible self-service plan management – empowering customers to adjust plans within guardrails

Delivery 1

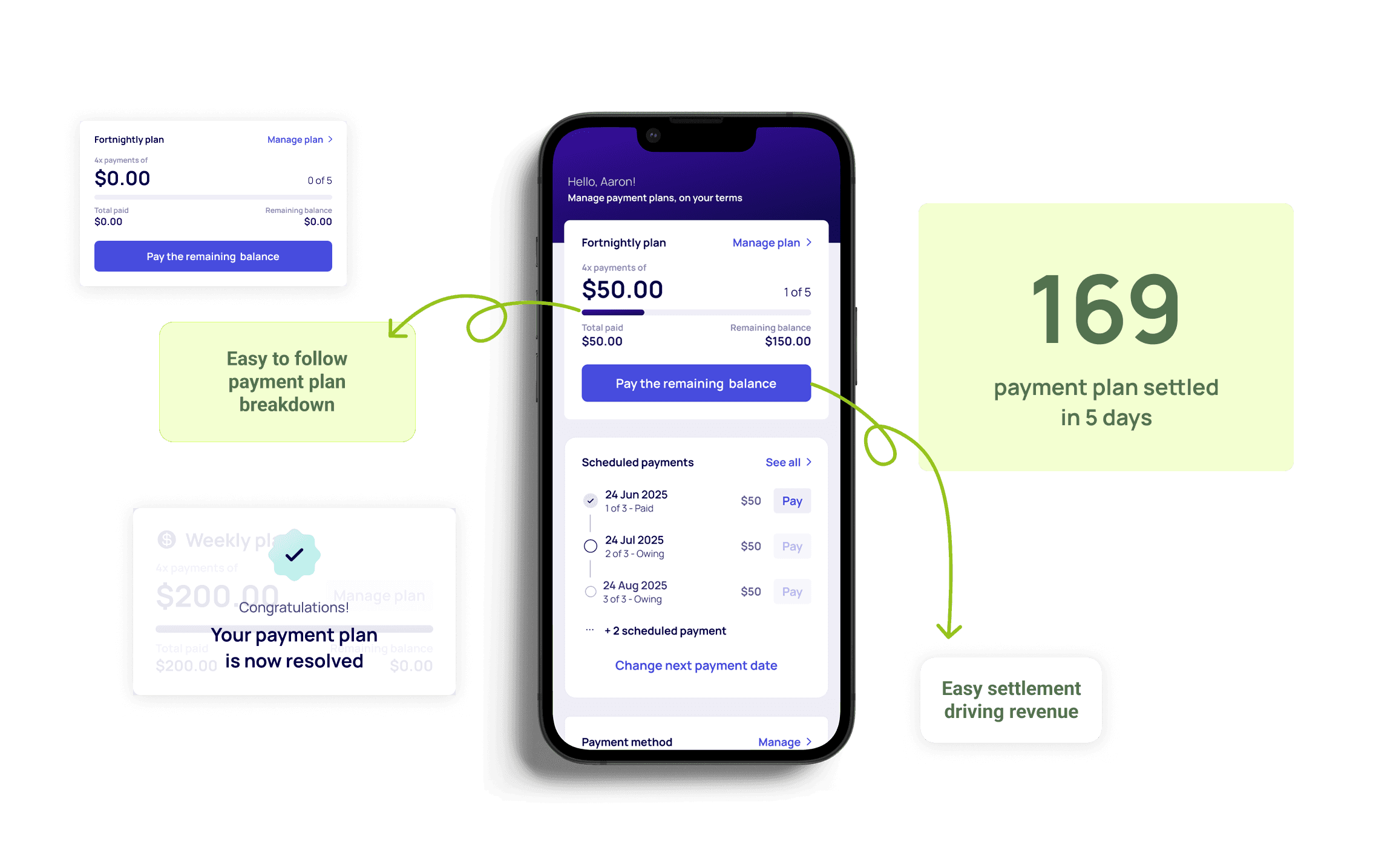

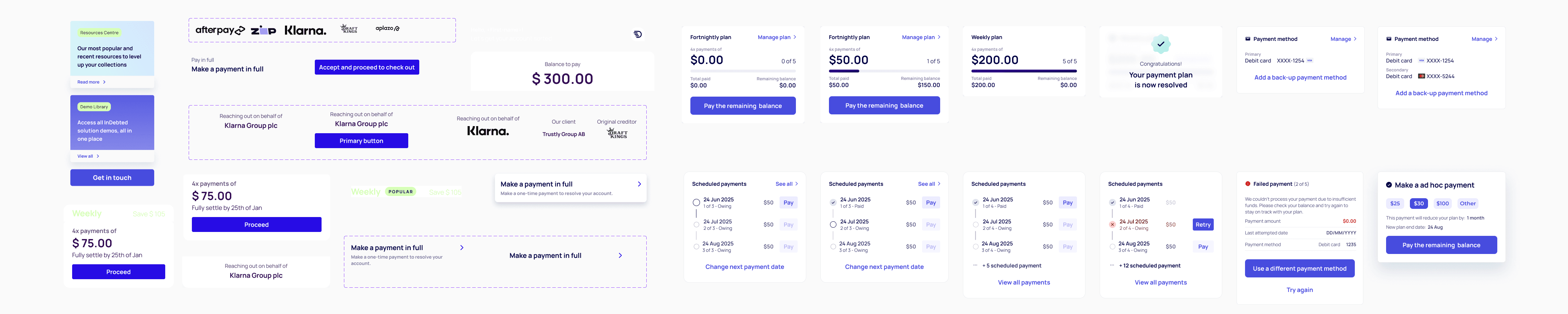

Plan details + Resolve plan

We combined both features into a single section. The new Plan Details + Resolve Plan design gave customers a clear breakdown of their schedule, history, remaining balance, and payment method, with a prominent “Pay Remaining Balance” action. This streamlined flow improved transparency, reduced support inquiries, built trust, and unlocked faster revenue through early settlements.169 payment plan settled in 5 days

Improved gross margins from early recoveries

Reduced CS contact for plan inquiries (we don't have the exact metrics)

Increased transparency and user trust

Phase 2

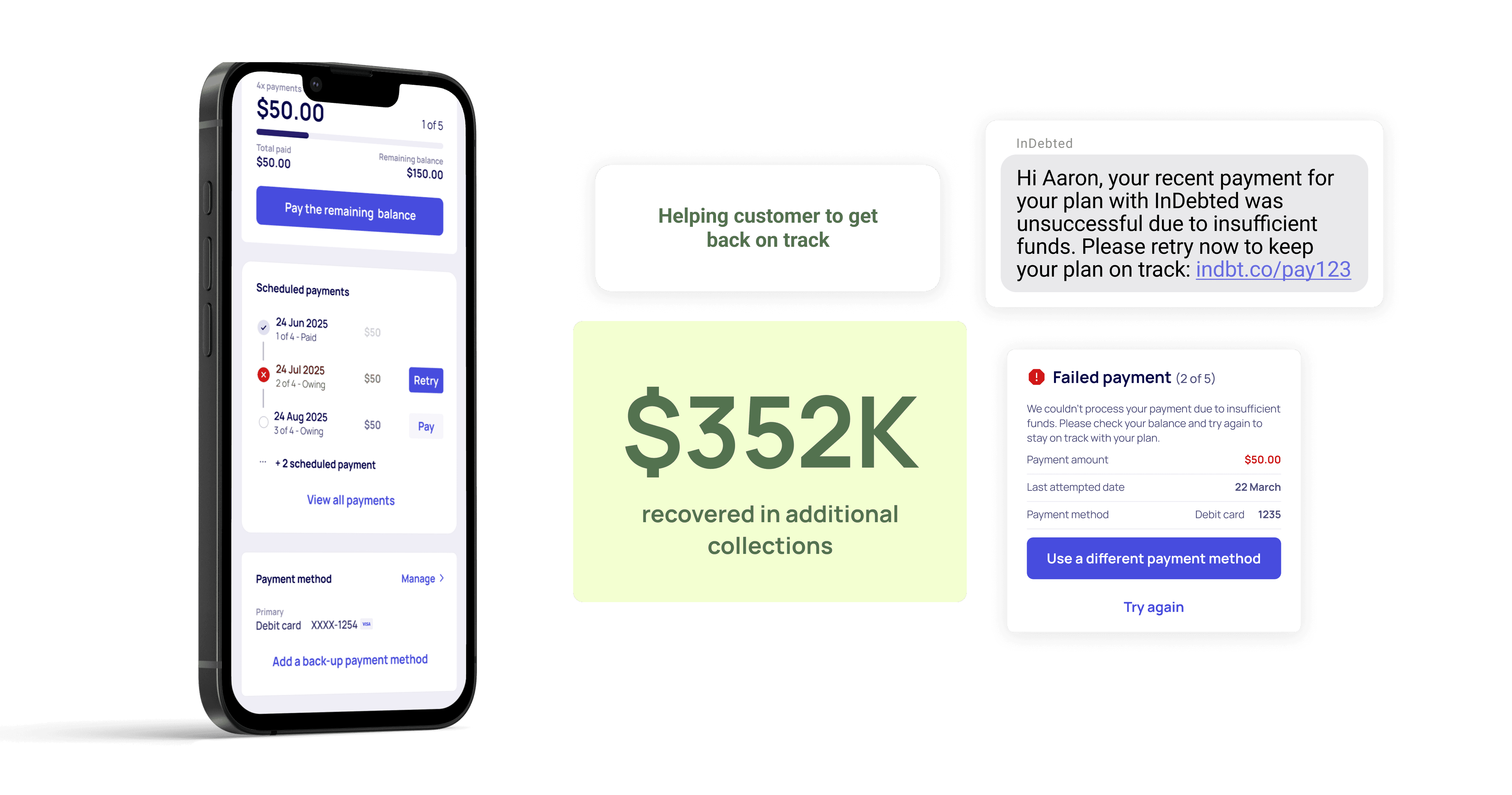

Manage failed payments

We introduced a customer-initiated retry button, supported by clear email and SMS nudges explaining the failure reason, so customers could retry instantly in-app without needing Customer Support.

82% success rate on retried payments (gross margins impact)

Total of 9.3K retry attempts

Majority retried within 24 hours

Reduced plan cancellations and CS contact

Key learnings

Lean design delivers real impact: Each MVP was scoped for fast learning, not just polish

Self-service is scalable UX: These tools didn’t just reduce support but strengthen the brand

Compliance can drive clarity: Constraints helped us design cleaner, user-initiated flows

This project was one of several key initiatives that helped the business secure multiple successful funding rounds, driving its valuation from $140M to $350M.