Rethinking onboarding experience

From frustrated to frictionless onboarding experience

Date

15 July 2020

Client Name

People's Choice

Services

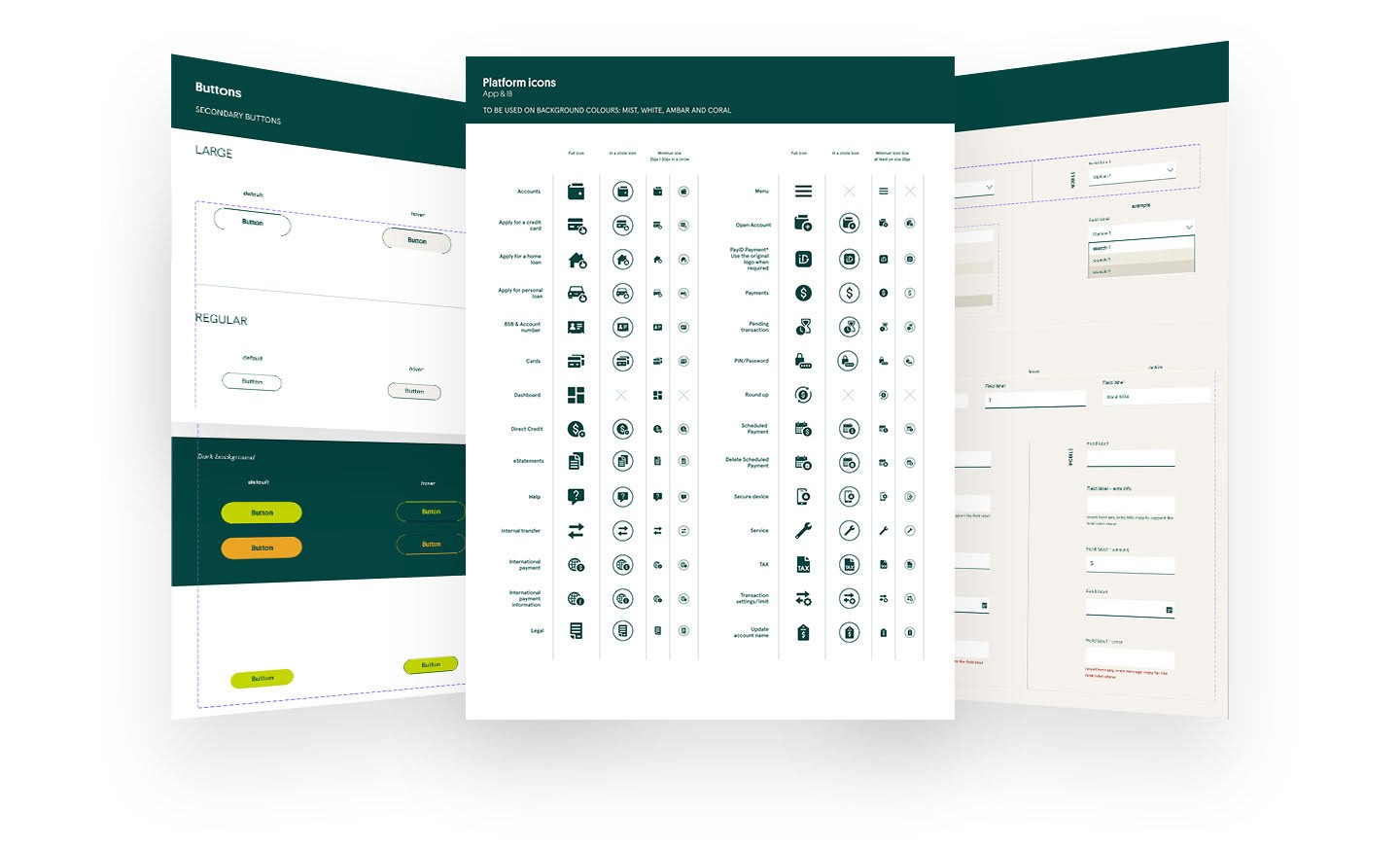

User experience

Reseach

user interface

Marketing

Overview

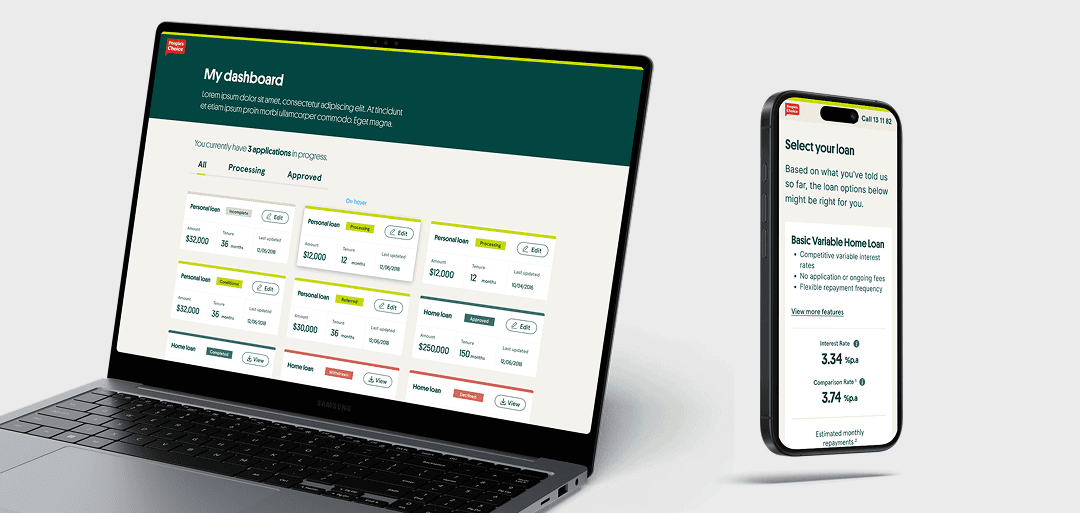

As a product designer, I was heavily involved in designing and developing prototypes, planning and performing usability testing, and implementing all stages of the user feedback loop. Further to that, I supported the UX team during discovery workshops and engaged with multiple stakeholders to understand key business requirements and leverage feedback. The business wanted to remove the customer frustration of filling out forms and visiting a branch by streamlining mobile account openings. Additionally, this would reduce account opening time from up to five days to less than five minutes.

The vast majority of the prospective customers (87%) that tried to open an account online dropped out of the onboarding process once they had to go through the complicated ID verification.

Discovery

Benchmark current onboarding

Six qualitative user interviews

were held to gather information on the most problematic aspects of the current onboarding process.

Competitor analysis

To inform the design and stakeholders, we evaluated competitors' onboarding flow. This helped us to understand what are customers expectations.

Identified problems

People's Choice advertises the onboarding process and digital but fails to mention that members need to go to a physical branch to finalise the account opening process. Customers expect to finalise the process entirely online and not to go through a physical branch to complete the process

Hypothesis

Given that we observed prospective members drop off (83%) the onboarding process once they face offline steps and ID verification steps.

We believe that by creating a streamlined fully digital onboarding flow could improve user expectations.

We should see a decrease in the drop-off rate to less than 50%.

HANDS ON

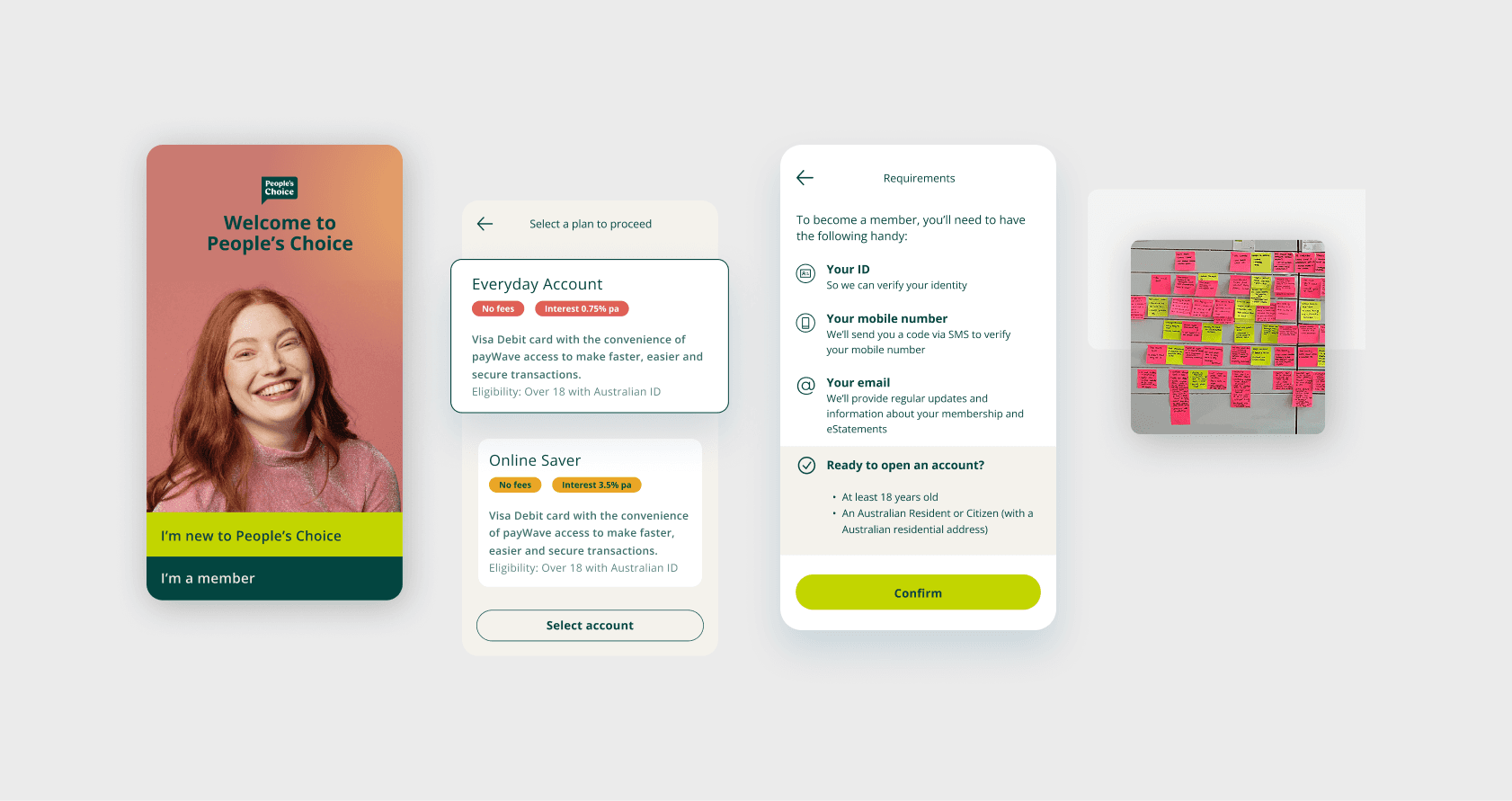

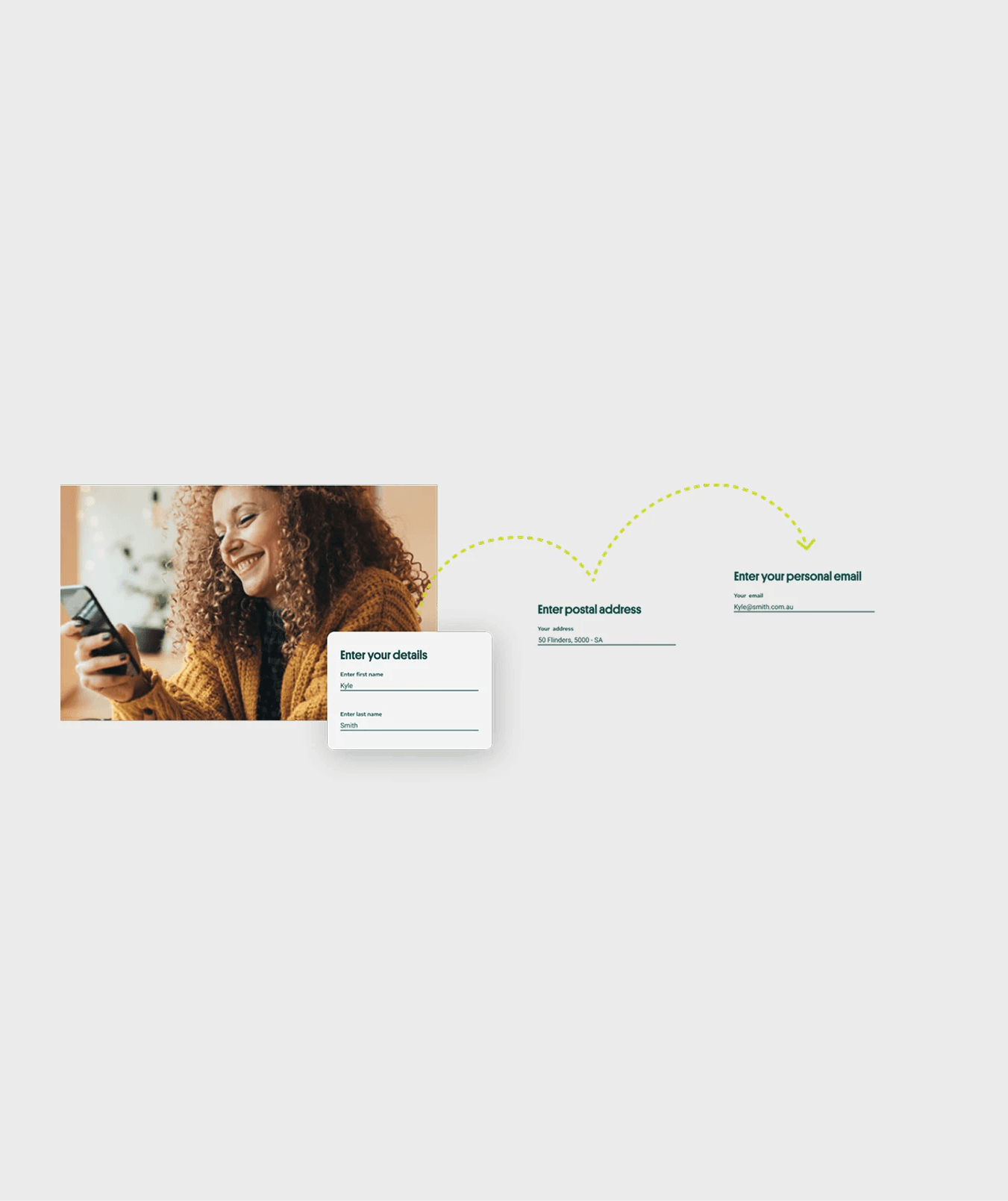

Multiple flow iterations based on customer input

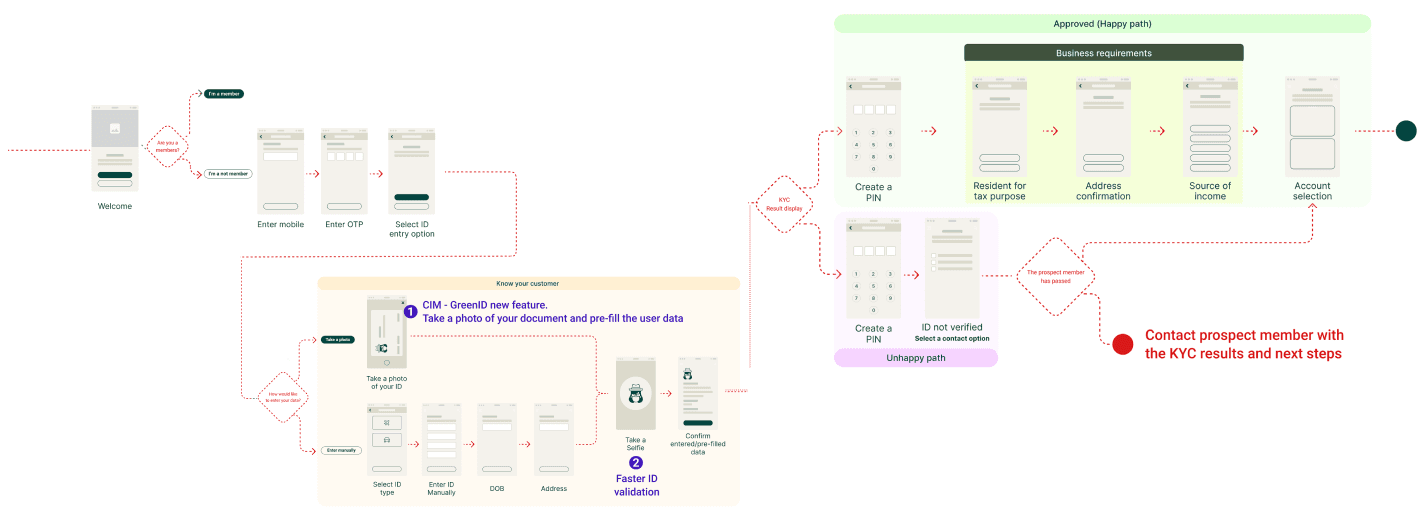

Based on our hypothesis it was time to create a flow that would address most of the pain points observed during the Discovery phase. The key areas of focus were:

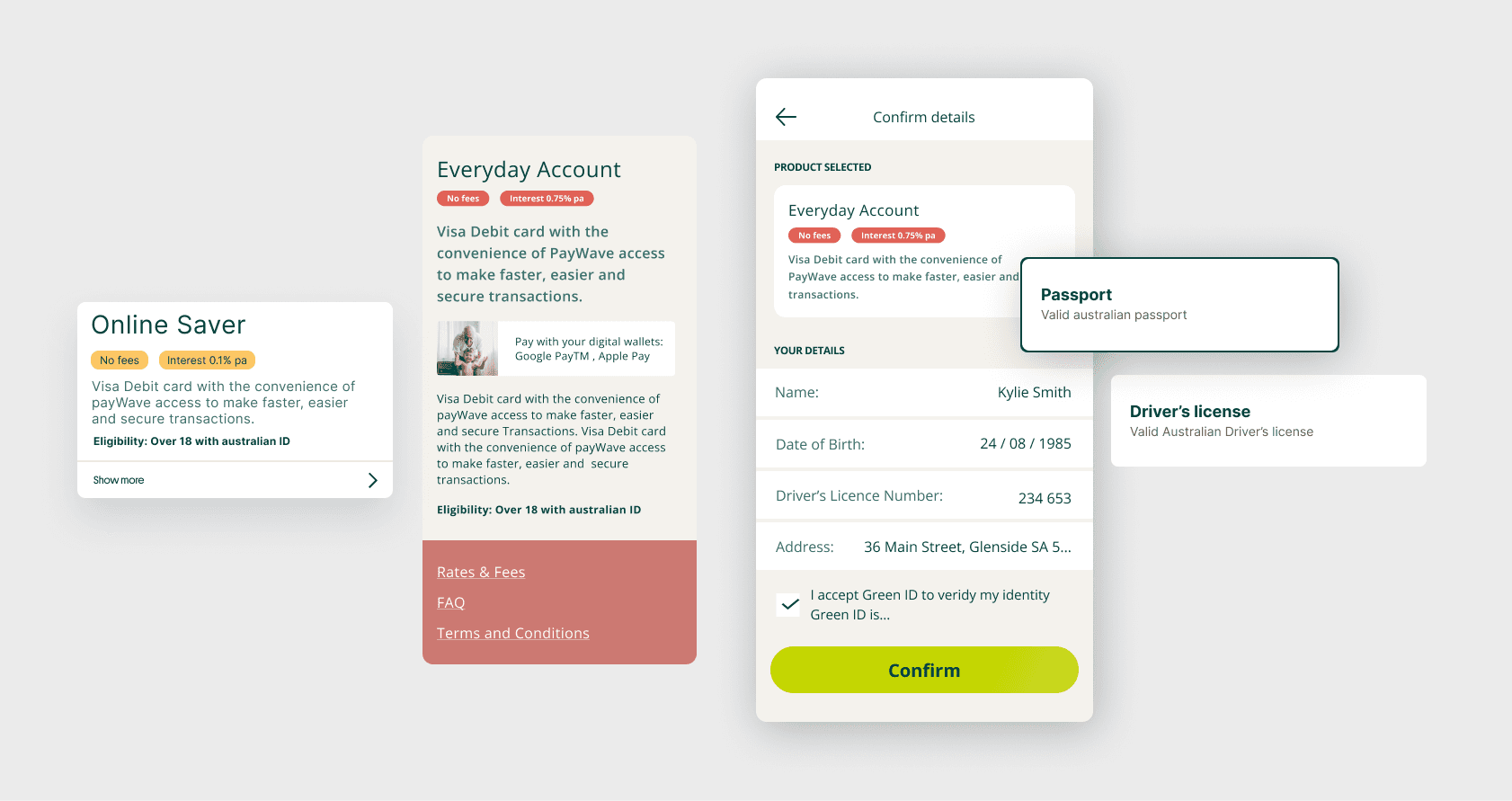

• When and how customers will select their account

• How can we help customers to feel comfortable with the KYC process and trust that PCCU will respect their privacy?

Usability sessions uncovered

"The onboarding process was painful and slow. It took a day to someone call me to get my account"

We can help to change customer brand perception

"I don't understand why you need all of this personal information"

The content needs to be refined

"I'm not sure how I feel about taking a selfie. I understand that could speed the process but I'm worried about how this image would be used."

We need to communicate well why we use customer data.

Key pain point solved

A new KYC process let members snap a photo of their ID and verify it almost instantly. With one tap, the system captured the image and pulled out key details automatically, making the process faster and easier.

5 min sign up

83% to 41%.

Reduction on drop-rate