Scaling operations and tacking customer needs

Turning support pain into opportunities

Date

8 Feb 2024

Client Name

InDebted

Services

User Experience

Research

Product Design

Challenge

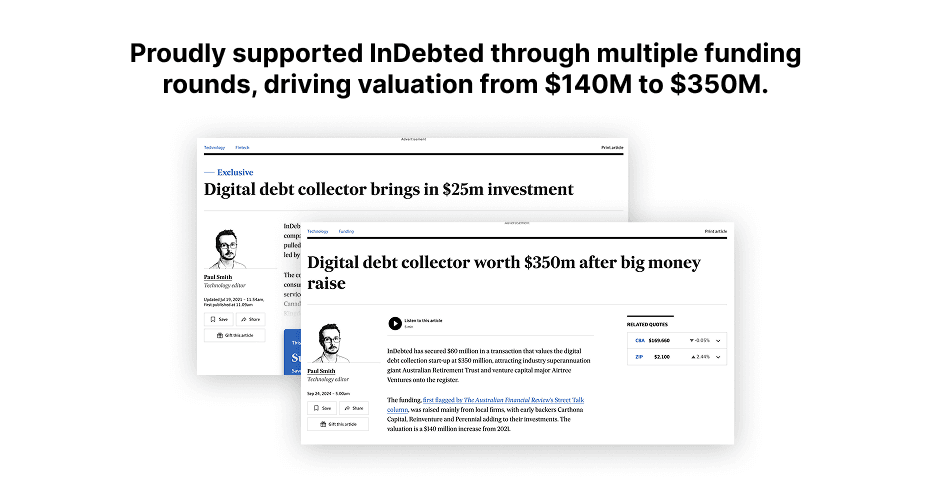

At this stage, InDebted had raised its Series B and was gearing up for the next funding round.

The business was scaling quickly across multiple markets, and the pressure was on to improve key metrics.Customer support analysis

The founder gave us a clear direction: we needed to scale in a way that was sustainable, not just fast.

Gross margins had to improve

Revenue needed to grow

Market expansion

Approach

To figure out where the biggest pain points were, I teamed up with a Product Manager.

We went straight to customer support data, looking at what people were asking for help with. If customers kept reaching out, that meant friction in the product.

The support team used 19 different tags to categorise requests. A few of them stood out as clear opportunities.

Research

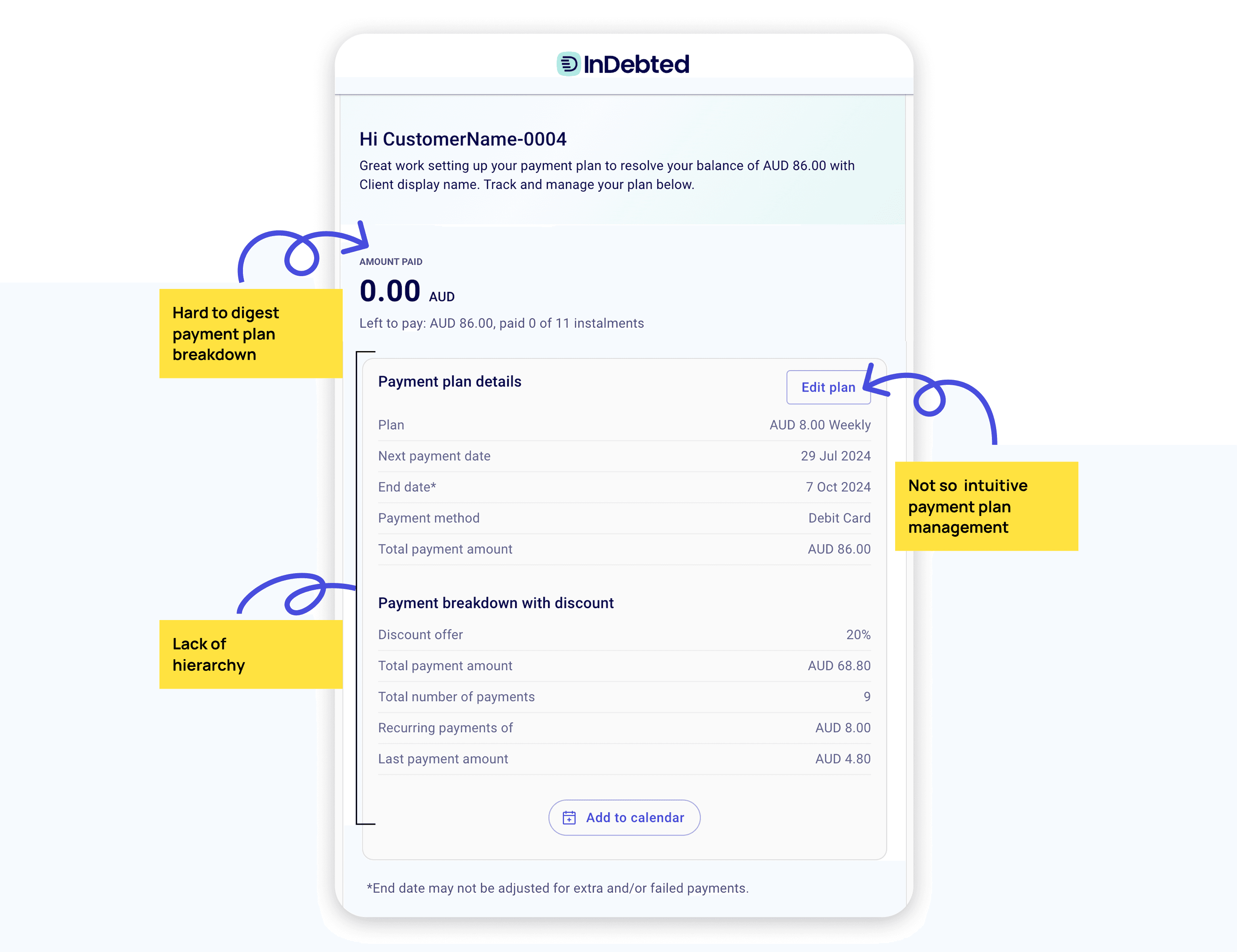

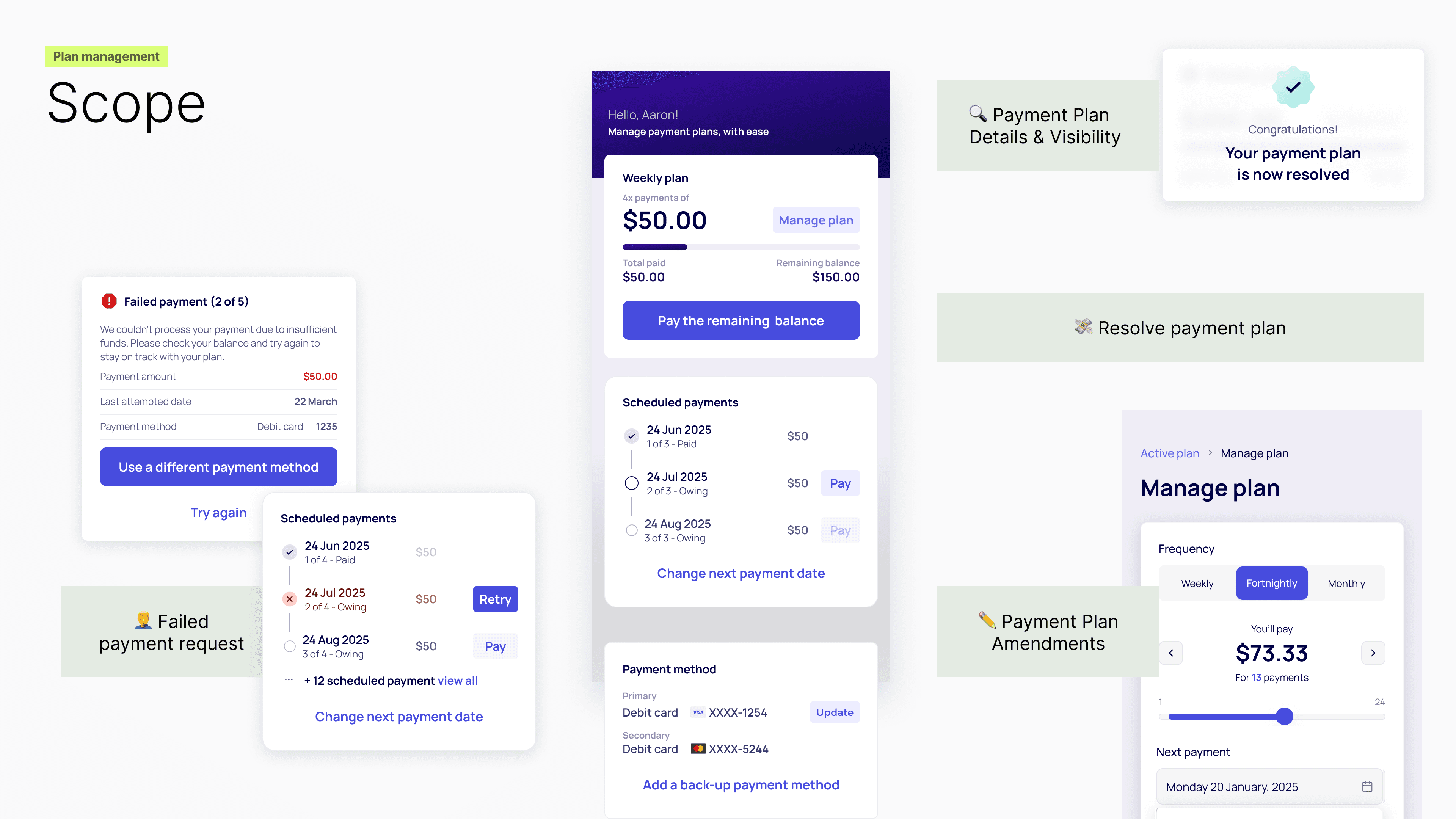

🔍 Payment Plan Details & Visibility

Volume: 2.7% of CS requests (Apr–Jun) - Low but with a high agent handling time

Customer questions: “What’s my remaining balance?”, “Which card/account are you charging?”, “Why was my last payment lower than expected?”

💸 Resolve payment plan

Volume:Low but high agent handling time to settle account.

Upside: This feature can reduce payments fees, breakage rate and gross margins

✏️ Payment Plan Amendments

Volume: 5.9–6.8% of all CS requests (6,000+ in 3 months)

Customer needs: Update payment method (32%), Adjust payment frequency to match income (32%)

🤦♂️ Failed payment request

Volume: below 0.5%

Upside: huge opportunity to tap into revenue without increase gross margins

Design Exploration

Talk through early concepting:

How you translated support insights into feature ideas

Sketches or quick flows tested with team

Exploration of user journeys across key pain points

Wireframes + Prototyping

Validate the concept with stakeholders

Align dev and product teams

Plan content, interactions, and logic before investing in UI polish

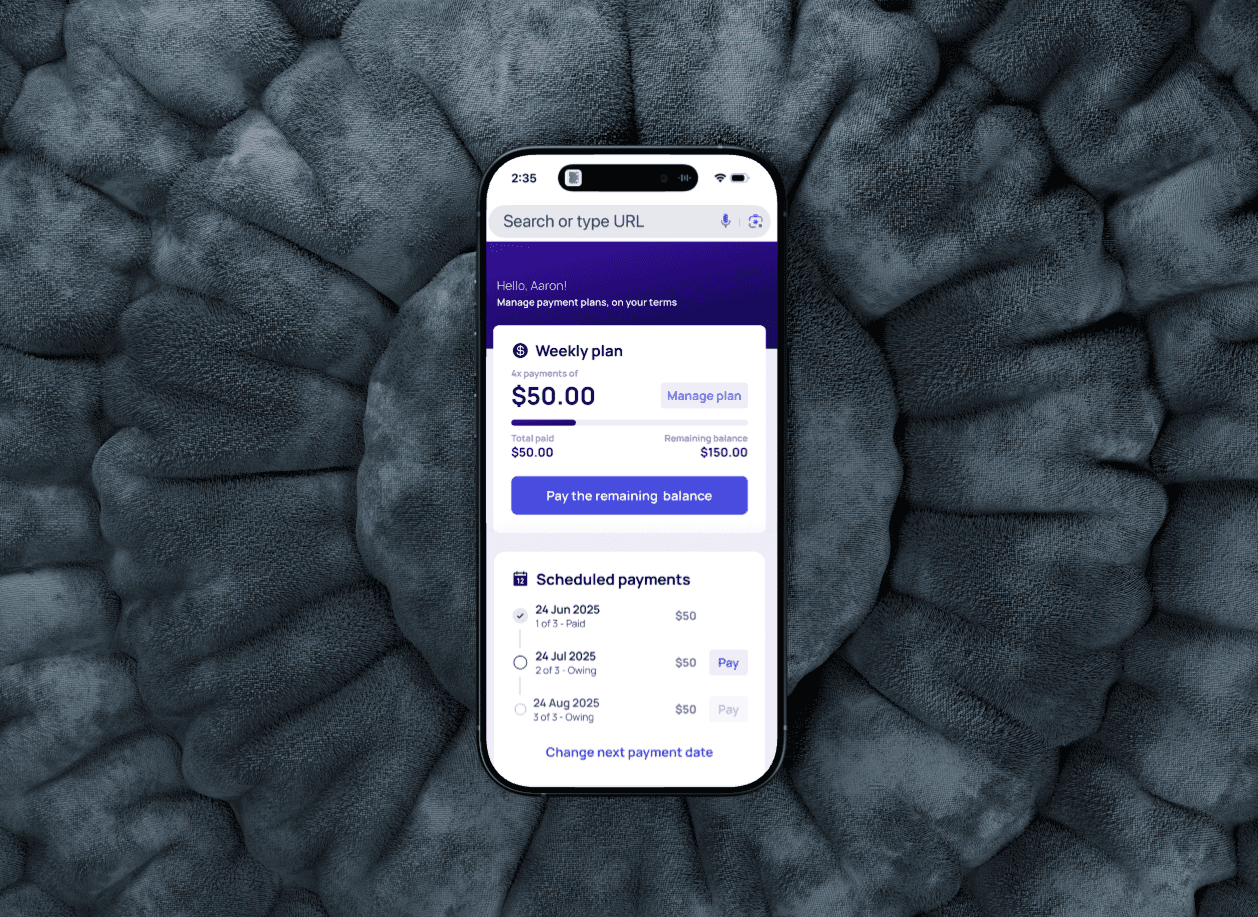

Our 4-Phase Strategy for Self-Serve Success

We designed and delivered a phased rollout of lean, high-impact features. Each phase addressed a core user pain and unlocked business value.

PAHSE 1

Payment Plan Visibility

Customers lacked visibility into their plan status, leading to confusion, broken trust, and unnecessary support contact.

What we shipped? | Impact |

|---|---|

A clear UI displaying

|

|

PHASE 2

Settle payment plan with ease

Customers who wanted to pay off their balance early had no easy way to do so, this required a manual CS flow.

What We Shipped? | Impact |

|---|---|

| 📊 169 accounts settled in first 5 days |

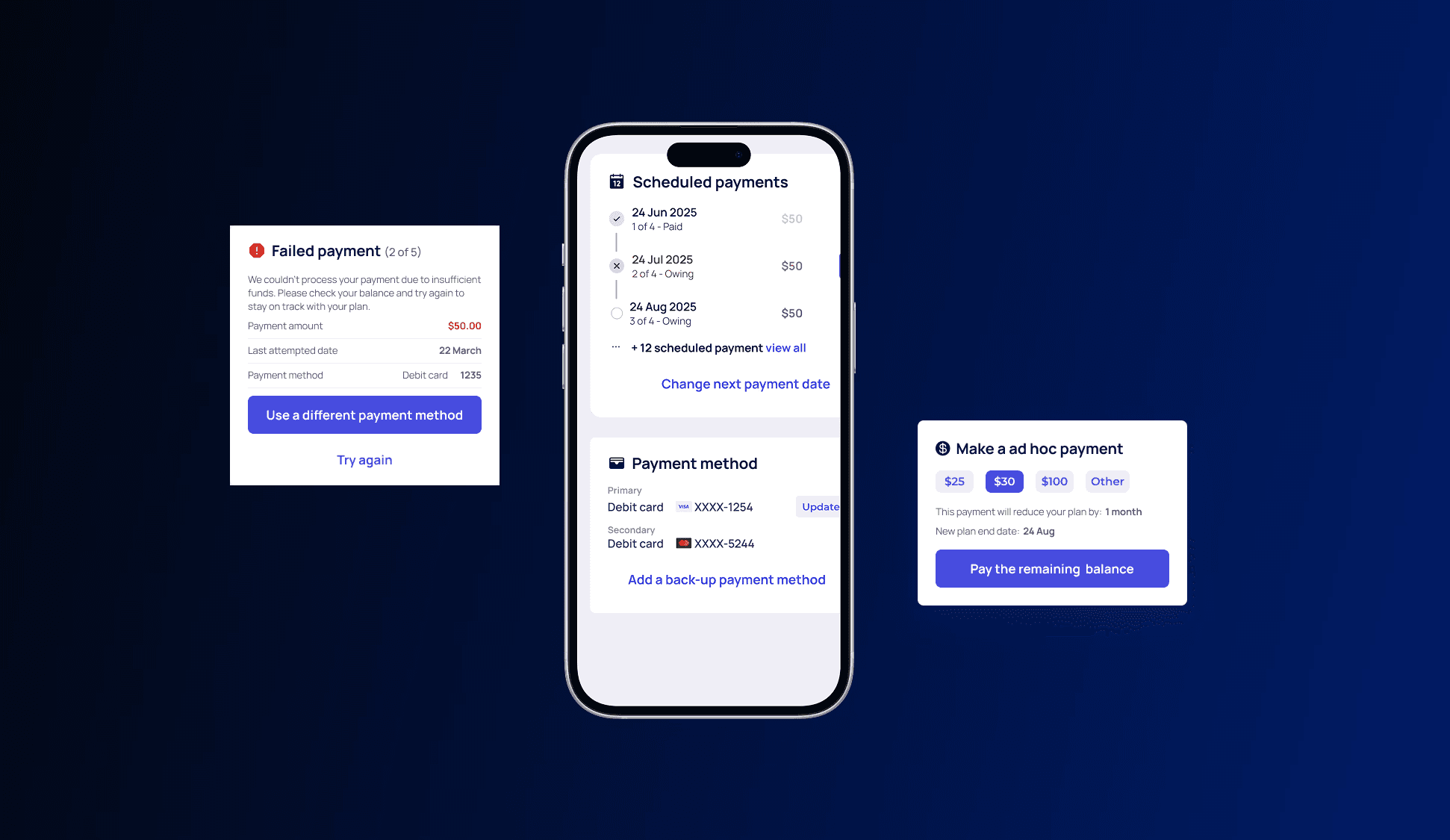

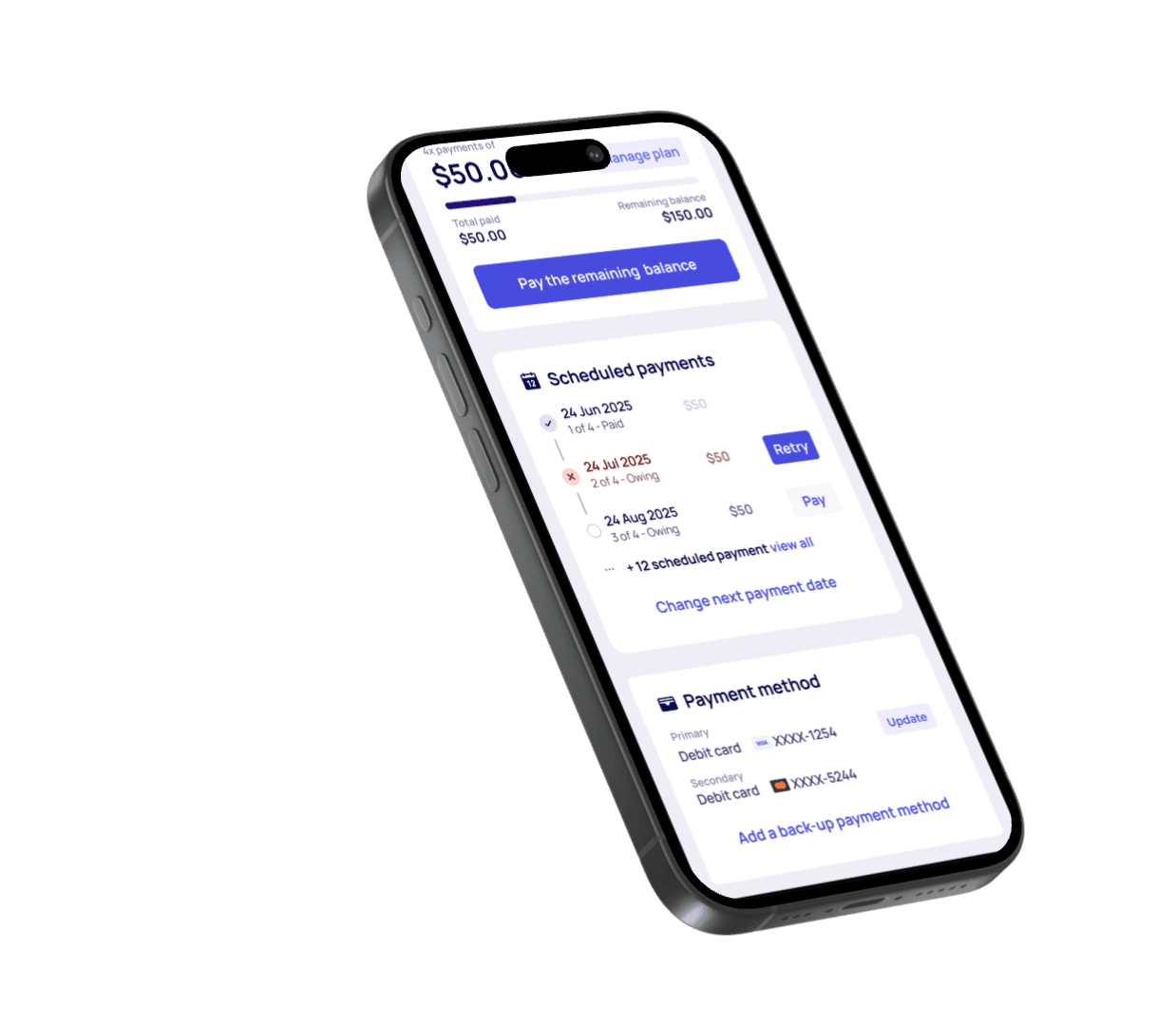

PHASE 3

Failed Payment

Recovery

Problem: When a payment failed, the platform didn’t allow retries. Customers were left in limbo, often defaulting or cancelling plans.

What We Shipped: | Impact (12 weeks tracking) |

|---|---|

| 📈 9.3K retry attempts ✅ 82% success rate 💰 $352K recovered in additional collections ⏱ Majority retried within 24 hours 📉 Reduced plan cancellations and CS contact |

PHASE 4

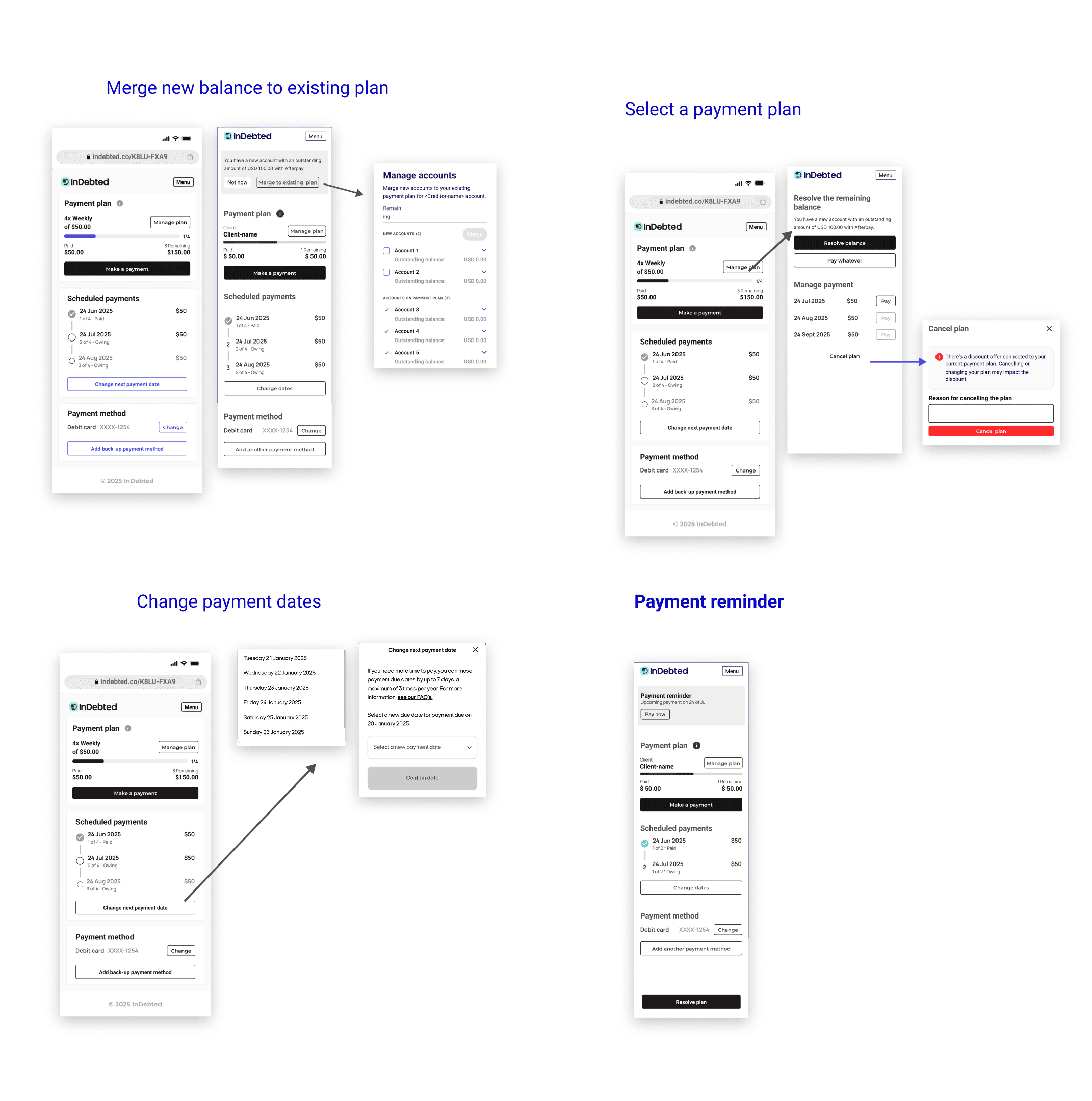

Plan Amendments

Amending plans (changing date, method, amount) required contacting support, delaying resolution and causing plan cancellations.

What We Shipped: | Impact: |

|---|---|

|

|

Key Lessons

Lean design delivers real impact: Each MVP was scoped for fast learning, not just polish

Self-service is scalable UX: These tools didn’t just reduce support they increased retention

Compliance can drive clarity: Constraints helped us design cleaner, user-initiated flows

Design learnings

In high-growth environments, I design for speed, clarity, and scale. I lead with lean UX, validate quickly, and invest in what drives real outcomes for both business and users.

$352K

in 3 months

82%

success rate on retried payments

~8000K

Email deflected over an year